The saga continues

It's been more than 3 months since our very first Climb newsletter. There's a lot of things that have been going on since, both within deFarm and the industry in general. And even though in this time of uncertainty, there's still a lot to learn. We've learned a lot and want to show you what we've been up to lately. But first, you'll probably want to know something about our context.

“deFarm was born in the middle of the Crypto 2022-2023 bear market. Projects and narratives are dying like flies, trading volume on exchanges was 1/10 of the last bull run peak, regulators are hunting everyone down, and funding for new startups was basically frozen. At the same time, the macro environment is incredibly bad. A tightening credit environment, global recession, and a looming threat of another world war/global conflict is bad for businesses everywhere (unless you're selling weapons, vital foods, or you're already super ultra-rich).”

This was something that we wrote in the first “Climb” article, and after 4 months, everything is still almost the same. Macro-wise, the FED is still hawkish and venture capital is still scarce. Geo-politics remain complicated, with the situation in the Middle East potentially escalating at any moment, making energy prices even more expensive than they already are.

On the other hand, we've observed some interesting economic situations that might affect the whole crypto market overall. Despite the gloomy outlook and the FED's seemingly hawkish point of view, gold prices have skyrocketed in the last 2 months. Some say it's because of the Hamas-Israel war, others believe it's due to China selling off US bonds to move to gold. We at deFarm and Chainslab understand one thing: prices increase because there's demand and buyers, and vice versa. It's often too late to try to find a logical reason behind the movement in prices of an asset.

The same thing should be applied to Bitcoin. Bitcoin broke out of the critical $30,000 level following ETF rumors, bringing a glimpse of hope back to the market. A lot of projects and founders will take advantage of this situation to launch their tokens without a proper product, but not us. In the last 4 months, we've been working on a lot of interesting stuff that we can’t wait to show you. Let’s see what we've done and what we're looking forward to.

Our Achievements

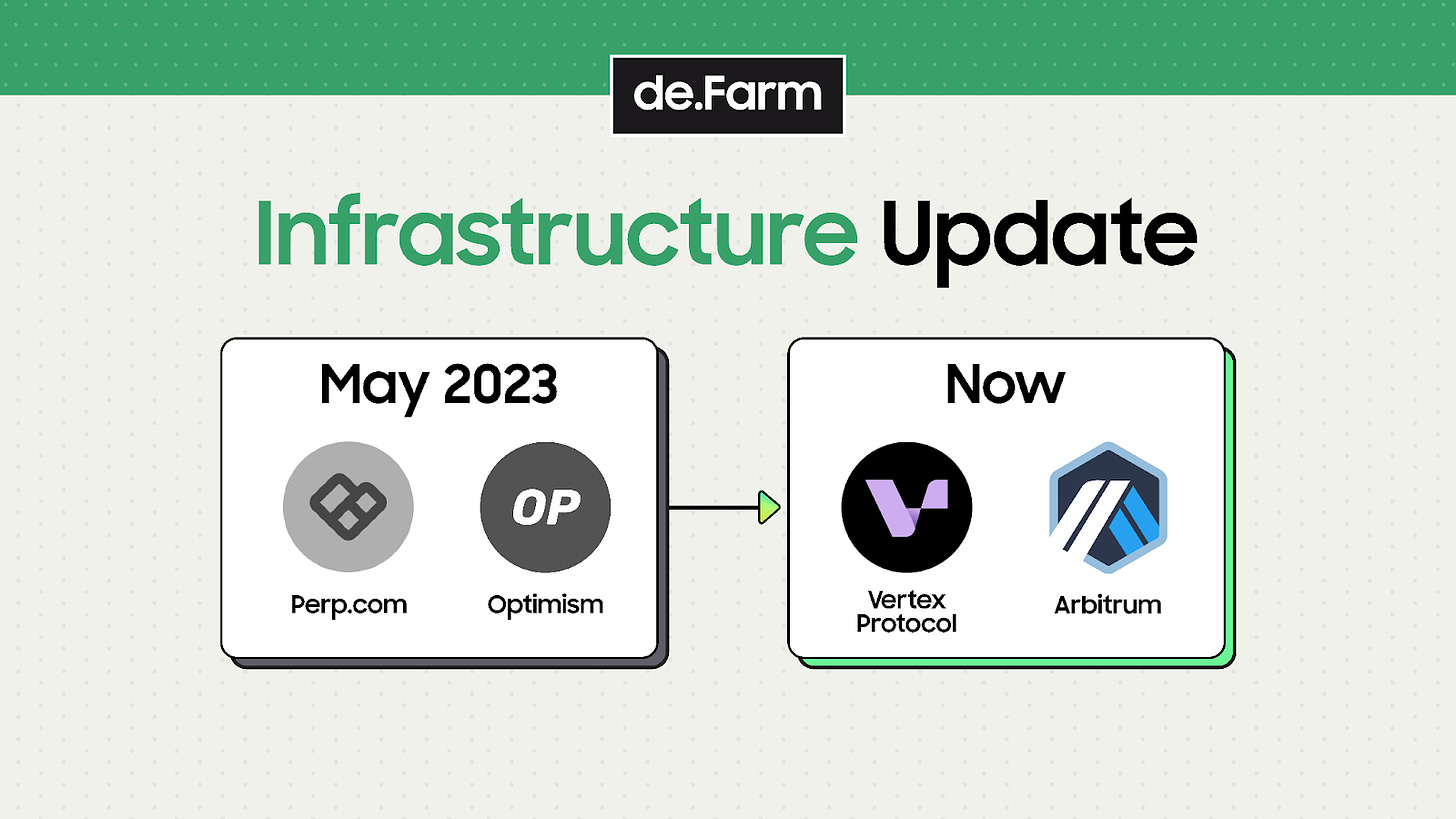

Public Testnet, Finally

The first version of our Testnet went live on Optimism Goerli back in May, with Perp.com as our Liquidity Partner. However, as demand grew, we realized the better option for us would be Vertex Protocol and Arbitrum as our Infrastructure Layer. So, we re-wrote our smart contracts, codes, UX/UI, and everything else to bring deFarm to Arbitrum. That doesn't mean we won't be on Optimism/Perp.com or other chains in the future. We'll expand according to the needs of our users, but for now, we're content with our infrastructure partners.

With that said, our Public Testnet was a modest success for us, thanks to our community. In about 2 weeks, we hit some remarkable metrics taken directly from our API:

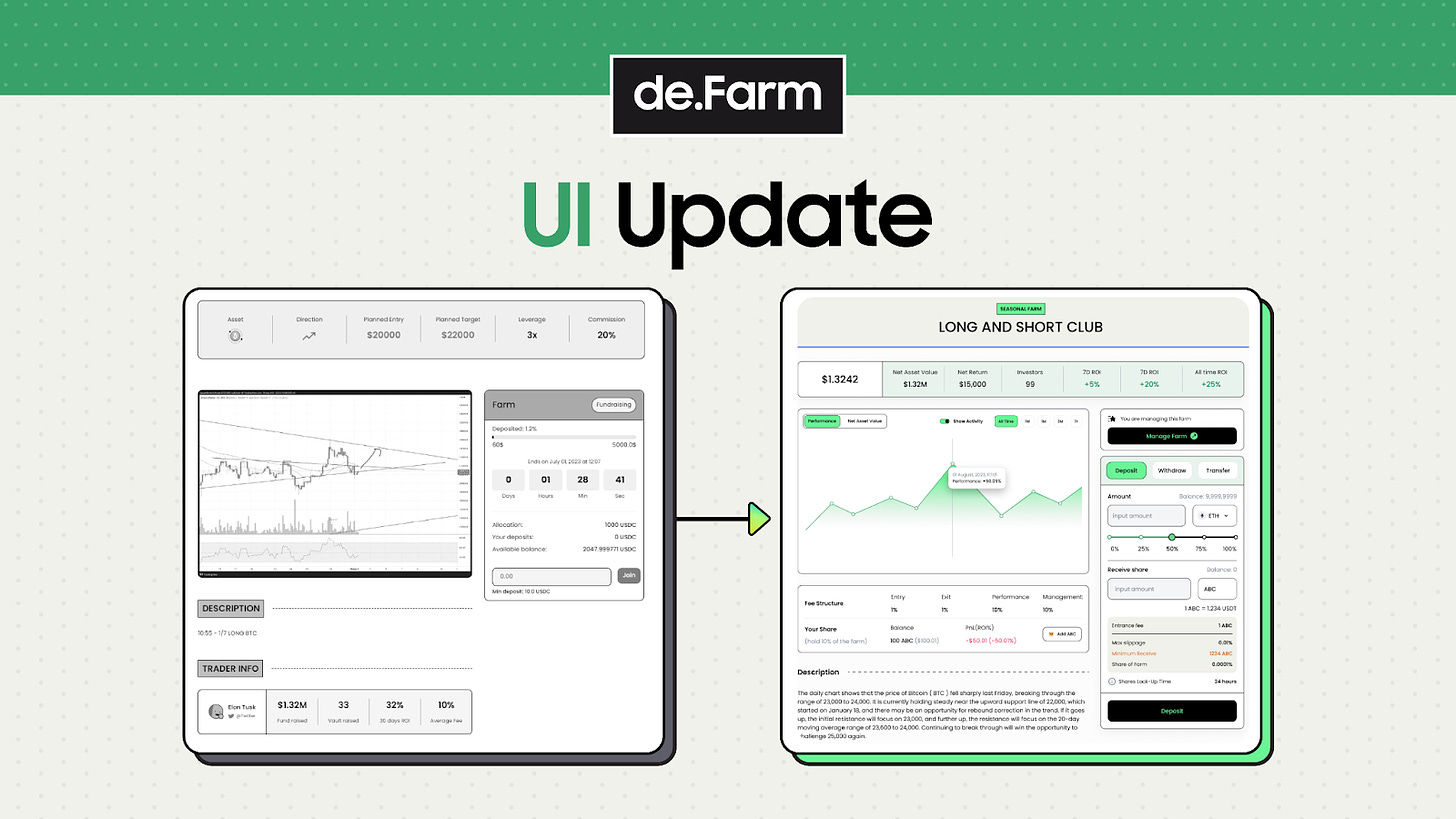

A New UI

The first version of deFarm's UI was designed mainly for testing purposes. We've revamped the UI considerably over the last 3 months, all aimed at providing a cleaner and more user-friendly experience. Below, you can find some of the examples. Of course, there will be many more updates in the near future, but we'll discuss that in the final part of this newsletter.

New Approach to the Community

One of the hardest decisions for us in the last 2 months was to close down our Discord server. While we still view Discord as a potential channel to disclose information and communicate with our community, the user experience of Discord is fairly hard for crypto natives/traders to learn.

As a result, we will focus on 3 different social channels to broadcast our messages and stay in touch with our community: X, deBank, and Telegram. Through these channels, we will identify our loyal users and plan to reward them in the future, so stay tuned ;)

What’s Next for deFarm

This is the part we are most excited about. Everything in the universe flows in cycles, and after winter, spring follows. In the next few months, there will be a lot of news waiting to be announced.

Our Funding Rounds

Despite the crypto winter, our Seed Round is nearing its end. Thanks to our friends at K300 Ventures, we will soon announce our impressive list of investors.

After the Seed Round concludes, our Private Round will start shortly. The Private Round is a special reserve for value contributors. If you are an institution or a community interested in participating, please fill out this form, or reach out to us at outreach@de.farm, or to our co-founder on Telegram @cuongdo.

The new Social Layers

deFarm has some exciting new things coming. One of them is the "deFarm Seed". It's like a special coin that shows how good you are on deFarm. You can buy, sell, or make these Seeds. If you have a Seed, you can join special groups and farms on deFarm.

We also have the "Social Point System". When you do things on deFarm, you get points. For example, if you buy a Seed or join a farm, you earn points. The more points you have, the better rewards you get.

deFarm will also bring up an "Achievement System". You can get badges and extra tokens by doing things like joining events, putting in money, and being top farmers. The more things you do on deFarm, the more gifts you can get. There's also a new feature where you can make your own profile. On your own page, you can show your unique trading style and achievements.

And The Mainnet Beta

Might be in December. With Social Layer integrated Single Farm.

So again, stay tuned, create some farms and wait for more information about how we will give back to our loyal community. Cheers!

a letter with passion, bear maker is not nice but it's where true heroes are born and trained. Let me see your color.

I'll do my best to help our community