Decentralized Asset Management: Past, Present and Future (Part 1)

In the dynamic realm of cryptocurrencies, a saga has been unfolding since Bitcoin’s birth in 2009. Traditional finance struggles to keep pace with the rapid digital evolution, spawning challenges and opportunities that demand inventive solutions. The pivotal role of effective asset management gains prominence as global economies and financial markets intertwine, impacting investors, institutions, and governments alike. A stellar example is the rise and fall of Three Arrow Capital, where Kyle and Su turned a modest investment into a colossal fortune, then watched its downfall due to the capricious Luna.

Yet, blockchain technology emerges as a knight, wielding transparency, security, and decentralized control, to challenge the traditional pitfalls of asset management. The saga of digital assets evolves, driven by the need to navigate the volatile crypto landscapes. Traditional asset management commands a staggering $126 trillion, while decentralized finance (DeFi) claims a fraction at ~$40 billion, but the cosmic collision between these realms’ ushers in a new era of possibilities.

As this chapter closes, the narrative continues, propelled by innovation and determination. The world watches as cryptocurrencies and asset management script their intertwined future, a tale still unfolding, rich with promise and potential.

Tracing the Evolution: The Past of Decentralized Asset Management

Amidst the swirling mists of uncertainty, a formidable obstacle arose - the specter of security concerns. Stories of grand exchange heists, like the vanishing of 740K Bitcoin from MtGox and the loss of 7K Bitcoin from Binance, whispered haunting tales of vulnerability and instability in the realm of crypto assets. These ominous breaches rattled even the most audacious asset managers, causing their aspirations of embracing crypto investments to waver in the face of such peril.

As the crypto market matured, a transformative era dawned - the late 2010s witnessed the rise of DeFi, an innovative movement ignited by the desire to forge a financial landscape free from intermediaries. DeFi, a symphony of decentralized financial protocols and applications, harnessed the power of blockchain’s smart contracts to grant users full control over their assets. In this era, novel concepts like staking, yield farming, and liquidity mining took center stage, captivating the hearts and minds of normies and degens.

One of the first notable DeFi asset management protocols that gained huge traction was Yearn Finance. Launched in 2020, Yearn provided an automated yield farming platform, enabling users to optimize yield generation across various DeFi platforms. It allows investors to make a single deposit which then routes through various strategies attempting to capture the highest yield. Vault products help mitigate costs associated with rebalancing or moving between protocols, especially for smaller balances. They also help engage in more exotic strategies, such as those leveraging options, without having to manually execute them yourself.

At that time, you can get rewards up to 1,200% APY on Yearn. Sounds crazy, right? Investors mostly just only learned about the 8th wonder of the world, compound interest. Will I pay back in 3 days, or in 1 week, or in 1 month? Of course, it’s just a ponzinomic, whoever provides liquidity early would get higher APY, whoever comes late would become exit liquidity. And naturally, a significant amount of those projects ultimately died, primarily due to their inability to maintain such elevated levels of interest.

Yield farming, staking and liquidity mining became prominent features in DeFi asset management. These involved users providing liquidity, locking tokens to DeFi protocols in exchange for rewards in the form of protocol’s tokens. It’s important to consider that DeFi was in its nascent stages during that period. The emerging business models predominantly emphasized short-term gains rather than cultivating a robust foundation for long-term viability and protocol sustainability.

Navigating the Present

As of the present day, asset management in the broader financial landscape has undergone significant changes, with traditional and digital asset markets coexisting and influencing each other. The convergence of traditional finance with the growing presence of digital assets and cryptocurrencies has led to a dynamic and evolving landscape for asset managers and investors.

Institutional adoption of digital assets has been on the rise, with major players like asset management firms, hedge funds, and pension funds embracing cryptocurrencies as a legitimate asset class. Many traditional financial institutions now offer cryptocurrency investment products, such as Bitcoin and Ethereum funds, to cater to institutional demand. Additionally, major stock exchanges have started listing digital asset-related products, such as Exchange-Traded Funds (ETFs), catering to retail investors seeking diversified exposure to cryptocurrencies. These funds allow investors to track the performance of a basket of digital assets, enabling them to participate in the crypto market without the need for extensive research and individual asset selection.

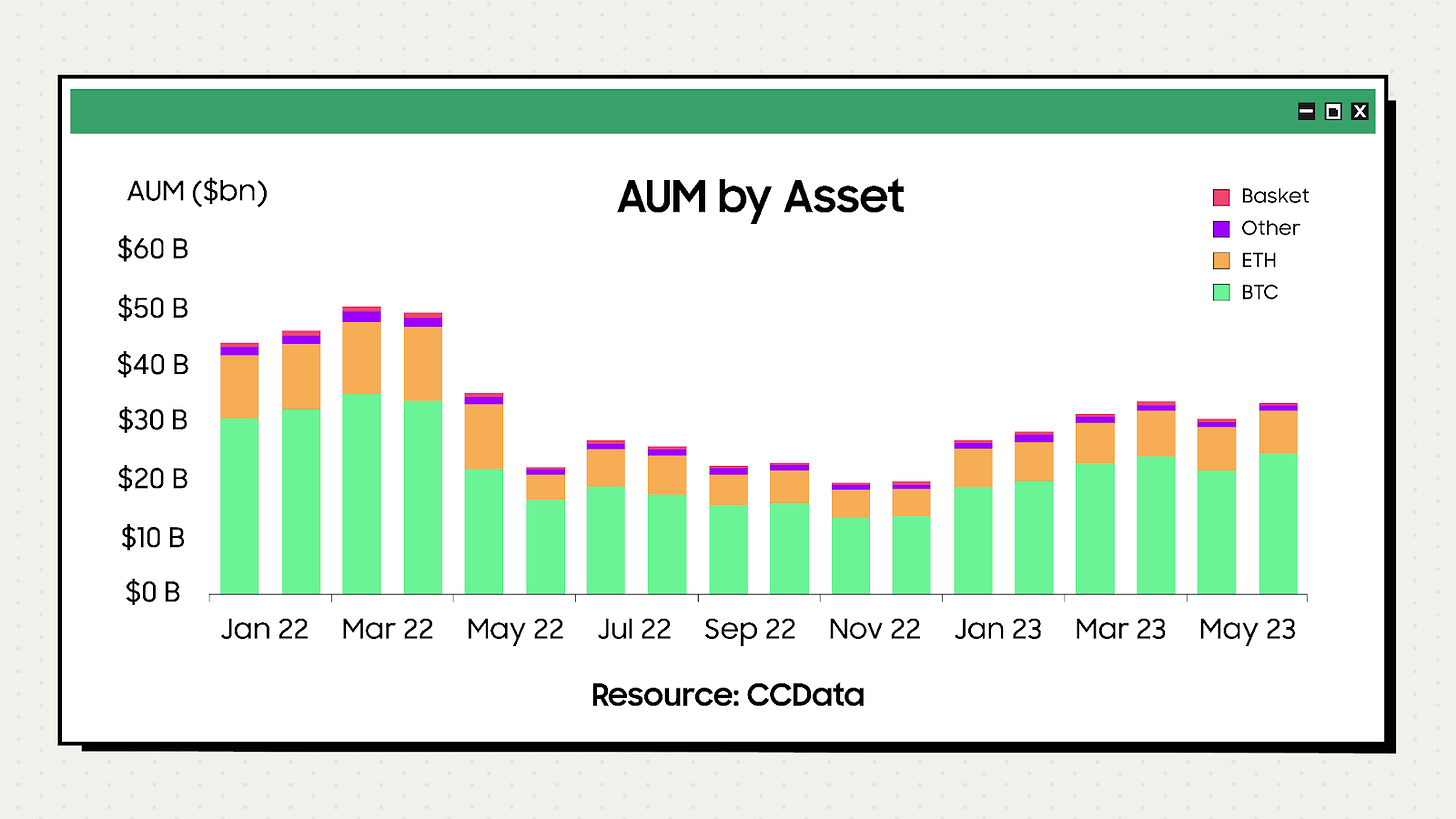

As of 2022, there are approximately $126 trillion in global assets under management (AUM). With global wealth at $329.1 trillion in the financial market, approximately 38.3% of all wealth is managed by the global asset management industry. According to CCData’s latest Digital Asset Management Review report, digital asset investment products have seen their total AUM surge 9.05% over June to reach $33.4 billion, in which, products offering exposure to Bitcoin saw a notable 12.4% rise in AUM to $24.4 billion under management of Blackrock, Grayscale, Bitwise, etc. This increased integration of digital assets into traditional markets is a testament to the growing acceptance and recognition of cryptocurrencies as viable investment options.

To understand why decentralized asset management hasn't taken off as much as other DeFi protocols yet, it's crucial to compare it with asset management in the traditional financial markets.

In the realm of TradFi, each step towards becoming an investor is meticulously outlined. This comprehensive process encompasses introduction, consultation, deal finalization, and ongoing customer support for investors. Within the TradFi framework, these tasks are expertly managed, leaving investors with a straightforward role: deposit funds, accrue interest, and deposit again and again. The burden of determining suitable stocks or crafting strategies is alleviated, minimizing the learning curve granting investors a sense of reassurance and liberation from such concerns.

Traditional asset management operates within a regulated framework that provides investors with a sense of security through oversight and protection measures. In contrast, DeFi nature gives rise to concerns regarding potential fraud and limited recourse, acting as a deterrent for traditional investors due to perceived risks. Furthermore, the convenience offered by the established infrastructure in TradFi, encompassing custodial services and advisory firms, contrasts with DeFi platforms, which often necessitate users to handle private keys and navigate intricate smart contracts, resulting in a steeper learning curve and potential errors.

The expertise delivered by professional fund managers in TradFi stands in juxtaposition to DeFi’s reliance on algorithmic strategies or community decisions, potentially impacting investors’ confidence. Ultimately, the maturity gap between the well-established traditional market and the nascent DeFi space plays a pivotal role, as DeFi continues to forge its reputation for reliability and security.

But why hasn't Decentralized Asset Management Gained Traction as Expected?

Over the past three years, asset management in DeFi has undergone significant transformation. Initially focused on maximizing returns for individual assets, the emphasis has now shifted towards creating robust and adaptable repositories that cater to users with limited or no crypto experience. This evolution has resulted in numerous benefits for consumers, who can now tap into the thriving economic activity within the DeFi ecosystem.

In addition to the mainstream DeFi protocols, there have emerged alternative approaches taken by platforms like Enzyme Finance and dHedge. These protocols diverge from the conventional passive management model and offer investors the opportunity to engage with vaults or pools managed by experienced individuals, including other investors, KOLs, and community administrators, not only institutions or protocols like before. Shout out to our old friend Babylon Finance for creating this market map for the ecosystem.

Overall, this shift in DeFi asset management signifies a more inclusive and user-friendly environment, empowering a broader audience to participate in the DeFi space and benefit from the various opportunities it offers.

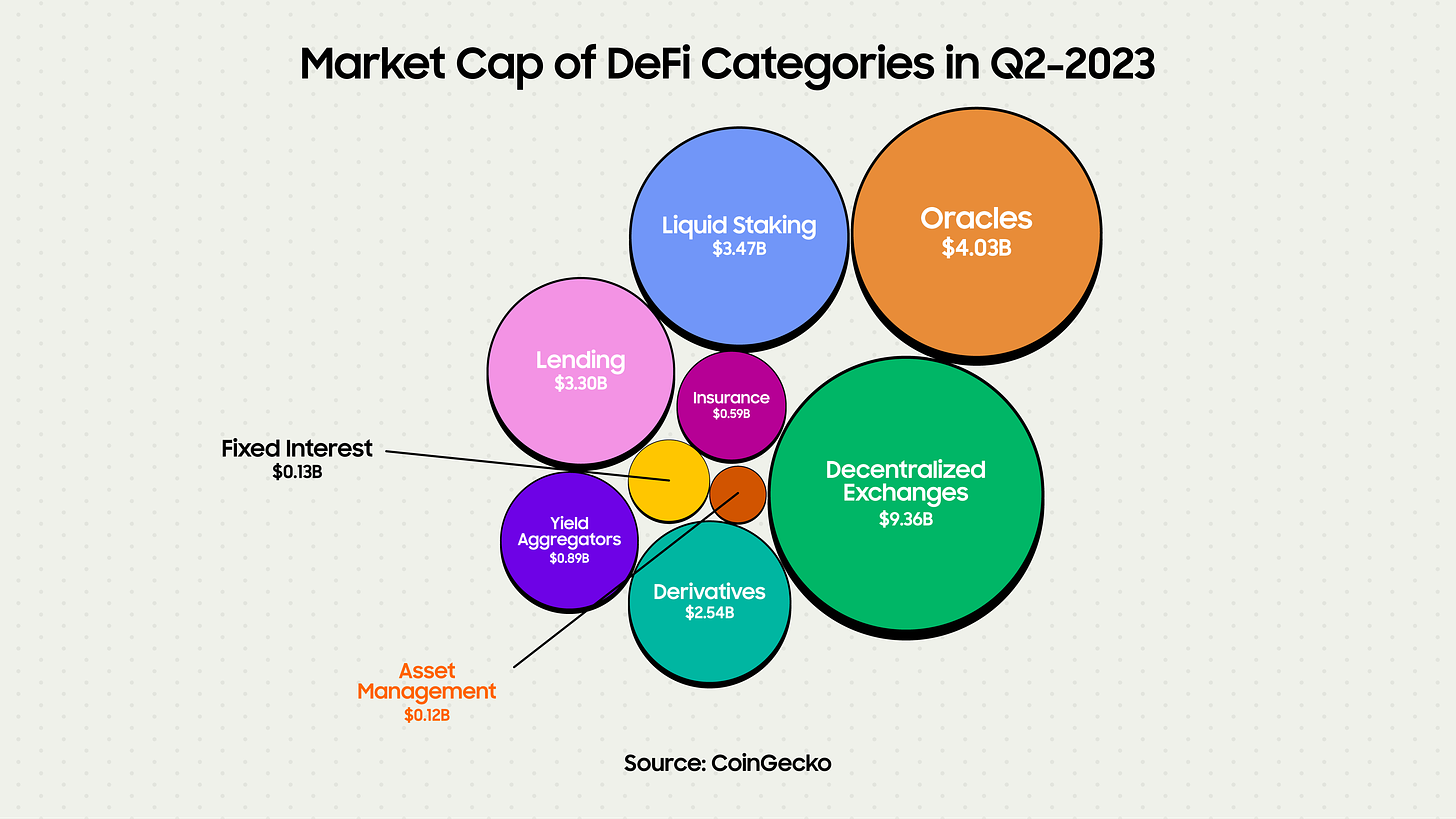

Despite the apparent advantages of on-chain asset management, it has not gained the expected traction in the DeFi space. According to CoinGecko’s Crypto Industry Report Q2 2023, asset management protocols experienced the most decline in percentage terms, dropping by 34.5% from $181 million to $118 million. Given that the total market cap of all crypto is ~$1.2 trillion, only about 0.01% of all crypto wealth is managed through decentralized asset management. In other words, decentralized asset management’s share of wealth is ~3830x smaller than traditional finance’s share of wealth.

Yes, we’re still early!

The crypto ecosystem presents a paradox of impatience and a short attention span in contrast to the patient and enduring strategies needed for effective asset management. The rapid pace favored by the crypto community contradicts the commitment required for successful asset management products. High-volatility options like leveraged crypto derivatives and meme coins often overshadow asset management, lacking their thrill and excitement.

Undoubtedly, your investors will find it hard to resist the allure of some heading evoking the story like this one. Meanwhile, their investments are yielding a modest 15-30% of the potential annual profit. And investors may question the rationale behind entrusting their funds to you, managers, aiming to generate only a few cents yearly return, while it appears that the others just need to join in meme communities to achieve substantial 100x-1000x gains like that one.

Crypto investors have distinct mindsets and cultures in contrast to those in other markets. The crypto market remains relatively novel compared to the traditional markets, prompting numerous individuals who weren’t actively seeking life-changing opportunities to venture into crypto. Unlike stock investors content with a 5% return, crypto investors and enthusiasts find satisfaction only when their investment doubles, at the very least.

The preference for active trading among investors further complicates matters, as it conflicts with the long-term engagement essential for asset management. Consequently, in order for decentralized asset management to flourish within the DeFi sector, alongside automated yield strategies, the market necessitates a diverse range of products tailored to cater to the preferences of crypto investors.

What necessary enhancements does DeFi need in asset management? What do users really need from asset management? How will decentralized asset management evolve in the next few years? You may find the answers with further insights in the next part of the article where our vision will take center stage.