Decentralized Asset Management: How deFarm Stacks Up Against Competitors

I. Introduction

In 2022, the asset management industry's scale is evident. Top firms, including BlackRock and Vanguard Asset Management, each manage assets over two trillion U.S. dollars, as cited by Statista. A BCG report provides further insight: the industry grew by 11% in 2020, totaling $103 trillion despite the challenges of a global pandemic. Of this, retail portfolios accounted for $42 trillion, and institutional assets were $61 trillion.

These figures are a testament to the industry's robustness.

But is it all as transparent as it seems?

Centralization in traditional asset management has long been a concern, primarily due to its opacity and concentrated decision-making. Often, decisions are made by a select few, leading to potential mistrust among investors. This issue extends beyond individual companies, reflecting a broader challenge within the traditional asset management industry.

DAM challenges this model, leveraging blockchain technology to democratize access, enhance transparency, and distribute decision-making power. In DAM platforms, strategies are often governed by smart contracts, ensuring automation, security, and adherence to predefined rules.

Enter deFarm, a platform that embodies the principles of DAM, aiming to set new standards in the space. But deFarm is not alone in this endeavor. The market is teeming with platforms, each bringing its unique approach and features. Platforms like Traderwagon, with its focus on social trading, Nestedfi’s portfolio copying feature, and Enzyme Finance, known for its vast assets under management, are all vying for a piece of the DAM pie.

In this article, we'll navigate the intricate landscape of DAM, comparing it with other notable platforms in the sector, and spotlighting deFarm's position and offerings.

II. Key criteria of DAM

Though the landscape of asset management platforms has seen significant innovation and growth, as investors and users navigate this space, it's crucial to understand the benchmarks that determine the effectiveness and reliability of these platforms. Here are the key criteria to consider:

Liquidity and Financial Efficiency

In DAM, liquidity is crucial for smooth trading and efficient capital allocation. This is often achieved through partnerships with large exchanges or liquidity providers. Financial efficiency is also important, especially when considering the impact of transaction fees on the profitability of trades executed by fund managers. High fees can quickly reduce profits for investors, making it essential for platforms to offer reasonable transaction costs.

Platform Infrastructure and Smart Contract Security

The underlying infrastructure of a DAM platform is essential for its performance, scalability, and security. This includes the blockchain it operates on and its ability to integrate with other DeFi protocols. The security of smart contracts is also critical. These self-executing contracts with the terms of the agreement directly written into code lines can be vulnerable to attacks if not properly designed. So that the reliability, transparency, and security of these contracts are vital. They should be published and executed as specified without any vulnerabilities.

Protection and Transparency

Protection against malicious activities is crucial in the decentralized world. This includes robust security measures to prevent unauthorized access, fraud, and other risks that have plagued the DeFi space.

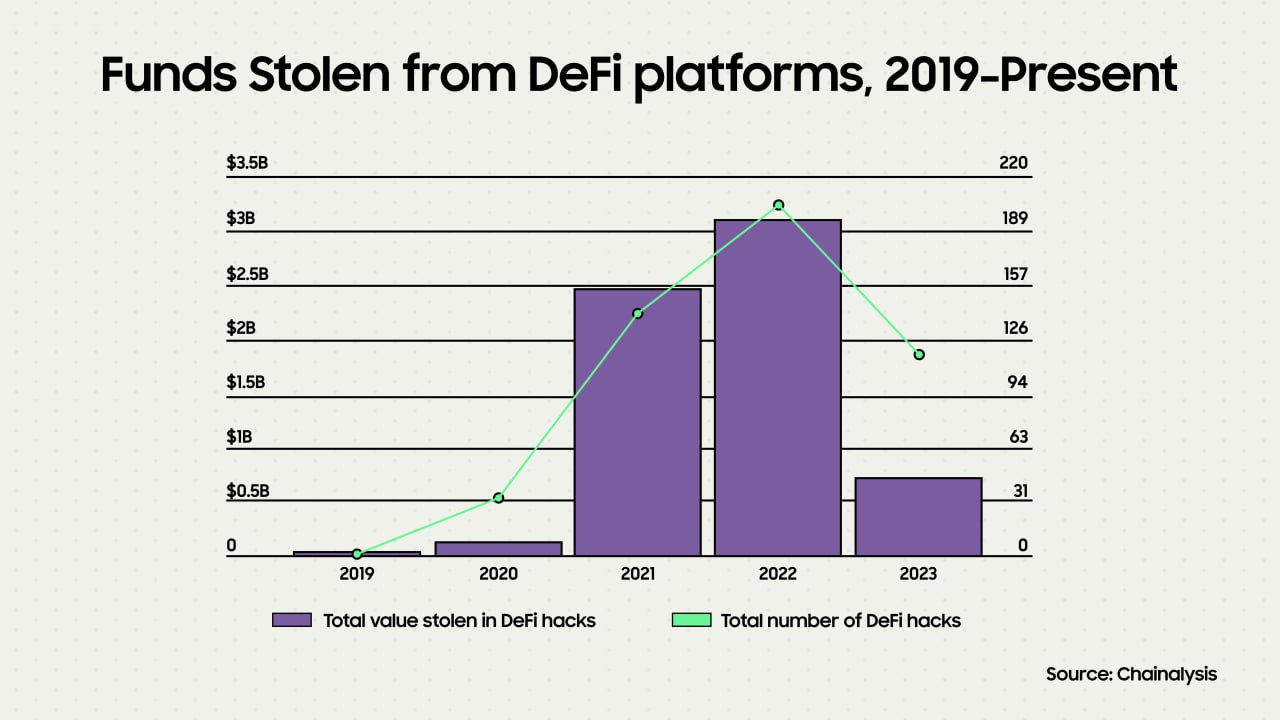

Since 2019, hackers have raided DeFi protocols nearly 500 times, absconding with $6 billion.

Transparency is another cornerstone. Users should have clear visibility into the platform's operations, trades, and returns. All actions should be recorded on-chain, providing a transparent and immutable record that builds trust and ensures accountability.

User Experience and Accessibility:

The user experience is a significant factor that determines a platform's adoption rate. It should be intuitive and accessible across various devices and platforms, including Web3 applications, mobile apps, and web-based interfaces. For newcomers, especially those unfamiliar with DeFi tools, the platform should offer guides, tutorials, and other educational resources to ensure a smooth and comprehensive user experience.

III. Competitor Analysis

TraderWagon

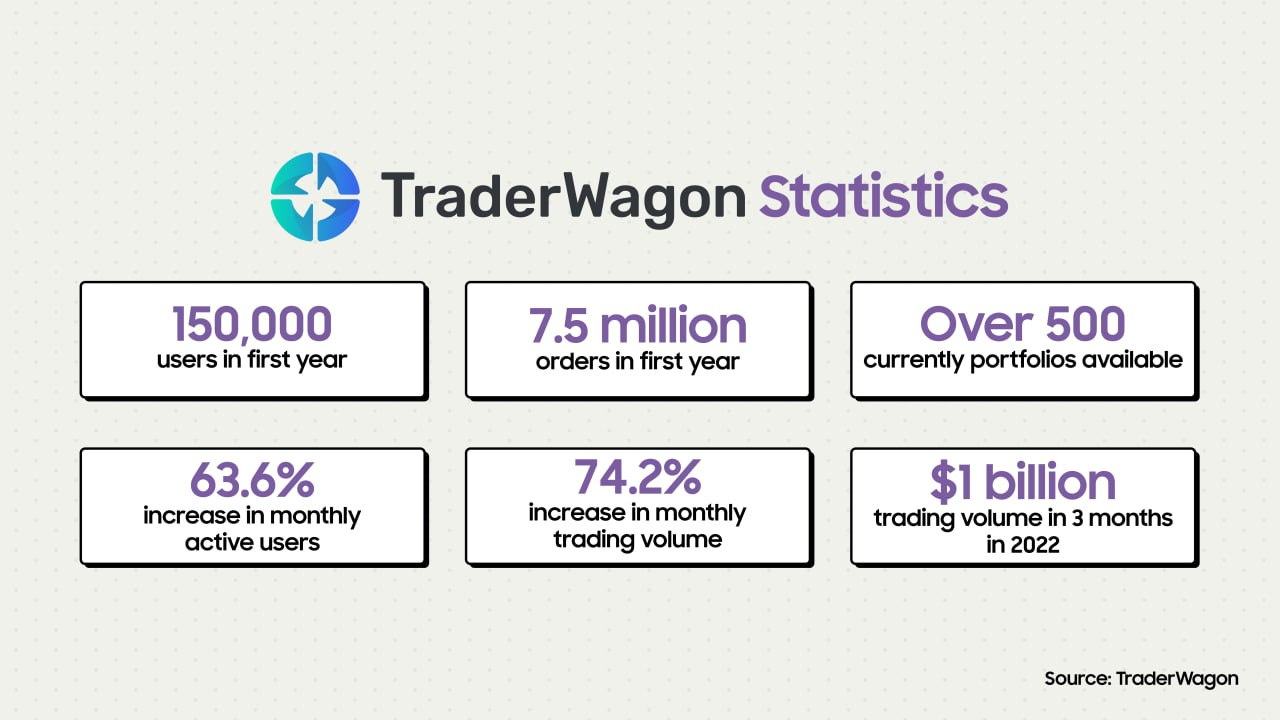

TraderWagon can be defined as a social trading platform that bridges the gap between experienced and novice investors. The platform enables users to engage in Social Trading. The idea of Social Trading is essentially simple: automatically copying the real-time crypto trades of experienced and profitable investors.

Liquidity and Financial Efficiency

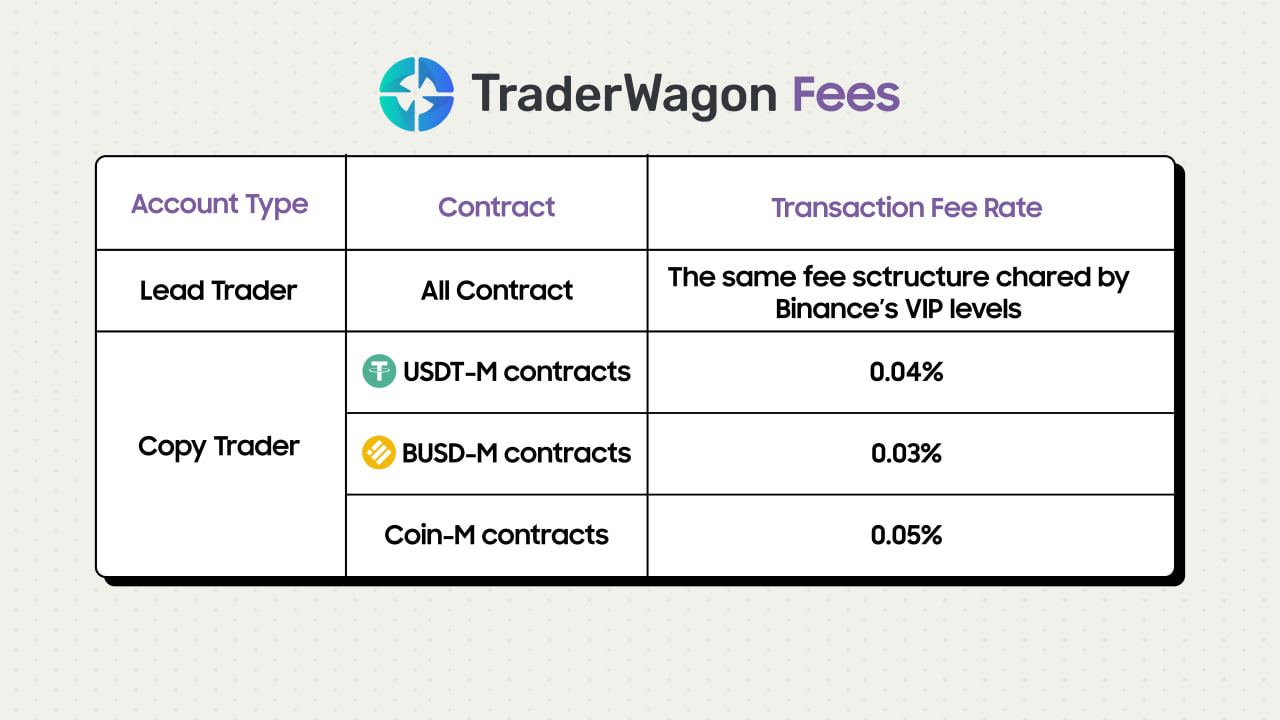

TraderWagon collaborates with Binance, a globally recognized cryptocurrency exchange. This strategic collaboration ensures that users have access to a substantial liquidity pool, which is essential for efficient trading operations. By tapping into Binance's extensive array of trading pairs, TraderWagon offers its users a broad spectrum of investment opportunities. An inherent feature of the platform is its profit-sharing mechanism. Specifically, Lead Traders are allocated a 10% profit share from their copy traders, based on the profits of the copy portfolios. This allocation is settled on a weekly basis. It's noteworthy that the fee structure of TraderWagon is intricately linked to Binance's VIP levels, with distinct rates for various contract types.

These fees, while competitive, are an essential consideration for users, especially when projecting long-term profitability.

Platform Infrastructure and Smart Contract Security

TraderWagon's operational model is distinct, functioning off-chain and utilizing Binance's API for its copy trading activities. This methodological choice offers certain efficiencies, particularly in terms of trade execution speed. However, it's worth noting that this approach might not align with the traditional decentralization features that certain blockchain solutions emphasize. The conscious decision to operate without on-chain smart contracts suggests that TraderWagon leans more towards centralization, potentially sacrificing some of the inherent security and transparency benefits associated with decentralized systems.

Protection and Transparency

In terms of security, TraderWagon, by virtue of utilizing Binance's API, inherits some of Binance's security protocols. These include established measures like two-factor authentication and the use of cold storage for assets. However, the integration of APIs does introduce an additional layer of complexity, and users should exercise due diligence, especially when interfacing their API keys with third-party platforms like TraderWagon.

Transparency is a primary feature of TraderWagon. The platform facilitates real-time visibility, allowing users to monitor and replicate the trades of other investors. This transparency extends to providing detailed statistics about each leader, encompassing metrics like trading performance and win rates.

User Experience and Accessibility

The platform is structured to cater to a diverse user base, including both copy traders and lead traders. The interface, whether accessed via web browsers or the mobile app, is intuitive, ensuring that users, irrespective of their familiarity with trading, can navigate its features with relative ease. The mobile app, in particular, enhances accessibility, allowing users to engage with the platform's features on-the-go.

The real-time copy trading feature is a testament to the platform's commitment to democratizing trading, enabling less experienced traders to leverage the expertise of their more seasoned counterparts. To further aid users, the platform also offers detailed guidelines with proper customer support on its Help Center.

Nestedfi

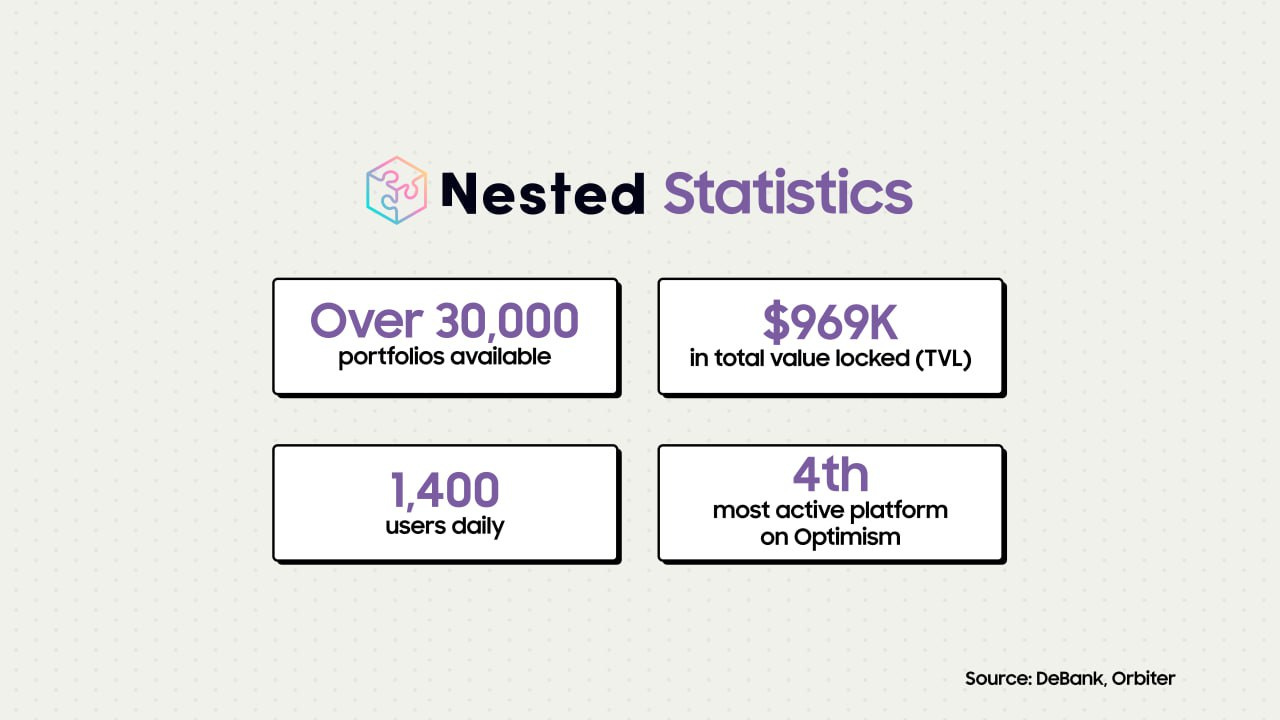

Nestedfi is a DeFi project that brings crypto trading, social engagement, and NFT-curated portfolio together in a platform. Nestedfi makes it possible for newbies to copy trade strategies from experienced crypto traders, experienced traders can share their strategies using an NFT-linked profile, NestedNFT, and be rewarded.

Liquidity and Financial Efficiency

Nestedfi's core innovation lies in its use of NestedNFTs, which encapsulate entire investment portfolios within a single NFT. This structure allows for the representation of up to twelve tokens within a single NFT, ensuring that each NestedNFT is backed by real, tangible assets. This design inherently offers a potential boost in liquidity, as each NFT can represent a diversified set of assets, streamlining trades and transfers. On the financial side, Nestedfi has implemented a fee structure of 0.3% for operations that maintain their TVL and 0.8% for those that reduce it. Importantly, these fees are not static; they're designed to be adjustable by DAO members, showcasing the platform's adaptability to evolving market dynamics.

Platform Infrastructure and Smart Contract Security

At the heart of Nestedfi's infrastructure is the NestedNFT technology. By using NFTs to encapsulate portfolios, the platform can simplify asset management and provide clear, indisputable ownership records. The smart contracts that power Nestedfi are pivotal. They handle the creation, modification, and replication of portfolios. A notable feature is the notification system: any modifications by the original portfolio creator are communicated to all replicators, ensuring consistent transparency and reducing potential risks. These contracts, given their centrality to the platform's operation, would be expected to undergo rigorous security checks to prevent vulnerabilities.

Protection and Transparency

Nestedfi places a strong emphasis on transparency and protection. All trades, returns, and portfolio modifications are recorded on-chain, ensuring complete transparency for all users. When a portfolio creator makes alterations, all those who have replicated the portfolio are notified, giving them the choice to follow the move or not. This level of transparency ensures that users are always informed and can make decisions based on the latest information. Furthermore, the platform's fee structure is transparent, with clear distinctions between different types of operations and their associated fees.

User Experience and Accessibility

Nestedfi is designed with user experience at its core. The platform breaks the trend of over-complicated crypto platforms by offering an unprecedentedly simple, social, and safe environment. Users can easily create, modify, track, and replicate portfolios. The platform also offers a full view of all user positions, allowing for a comprehensive understanding of one's investments. Additionally, Nestedfi is expanding its reach by launching on multiple networks, including Binance Smart Chain, Avalanche, Polygon, Ethereum, Optimism, and Arbitrum. With features like Web2 authentication, on-ramp & off-ramp facilities, and a user-centric vision, Nestedfi ensures a seamless and intuitive experience for its users.

Enzyme Finance

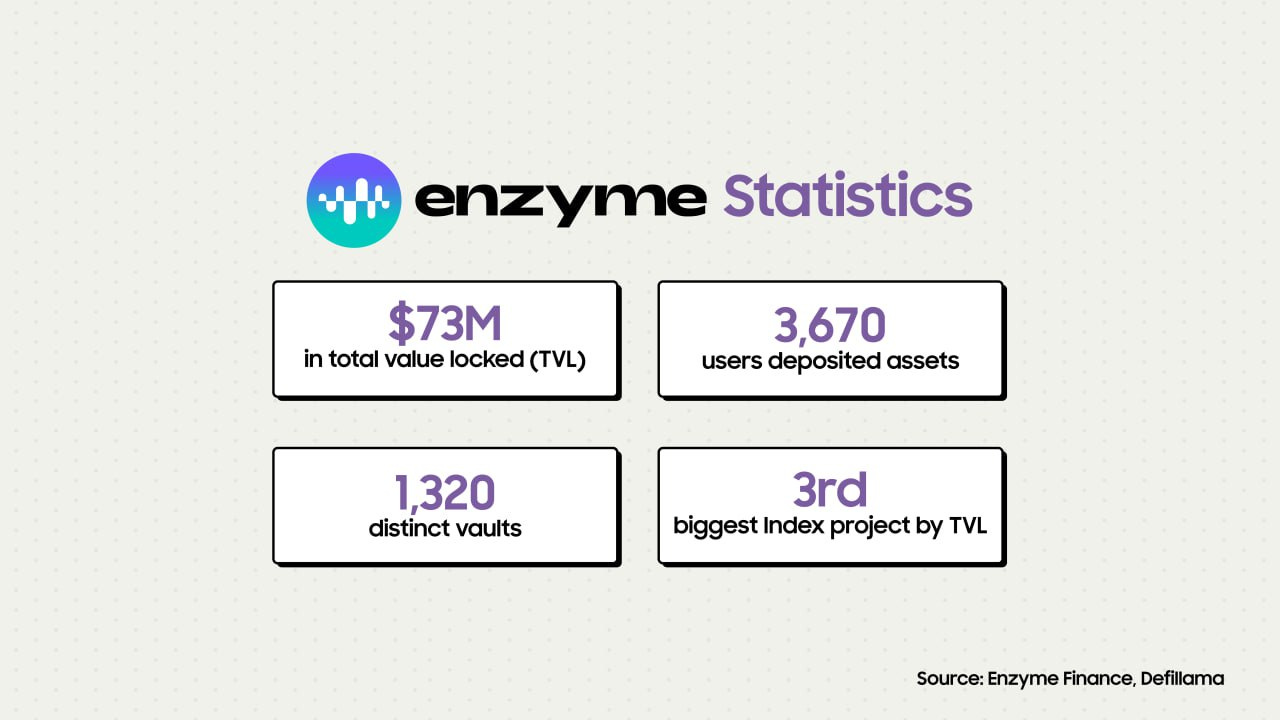

Enzyme is a DeFi Operating System designed for asset managers, DAOs, treasury managers and investors, offering access to 350+ digital assets. By automating the back and middle office processes through the use of smart contracts, Enzyme enables asset managers and fund sponsors to create their own tokenized investment vehicles.

Liquidity and Financial Efficiency

One of Enzyme's standout features is its extensive connectivity to the DeFi ecosystem. By supporting a wide range of DeFi integrations, from lending and borrowing to liquidity provision and derivatives, Enzyme ensures that users have ample opportunities to diversify and optimize their portfolios. The platform's support for over 200 tokens underscores its commitment to providing a vast asset universe for its users.

In terms of financial efficiency, Enzyme introduces a protocol fee, which is charged by minting additional vault shares to an Enzyme Council owned contract. Initially set at 50 bps of AUM, this fee can be reduced by the vault manager to 25 bps. Additionally, vault managers can set both a performance fee and a management fee. The performance fee is a percentage of the profits made by the vault, while the management fee is a percentage of the total assets under management. These fees ensure that the financial implications are transparent and manageable for users, but they also highlight the importance of assessing the overall cost structure when considering investment returns.

Platform Infrastructure and Smart Contract Security

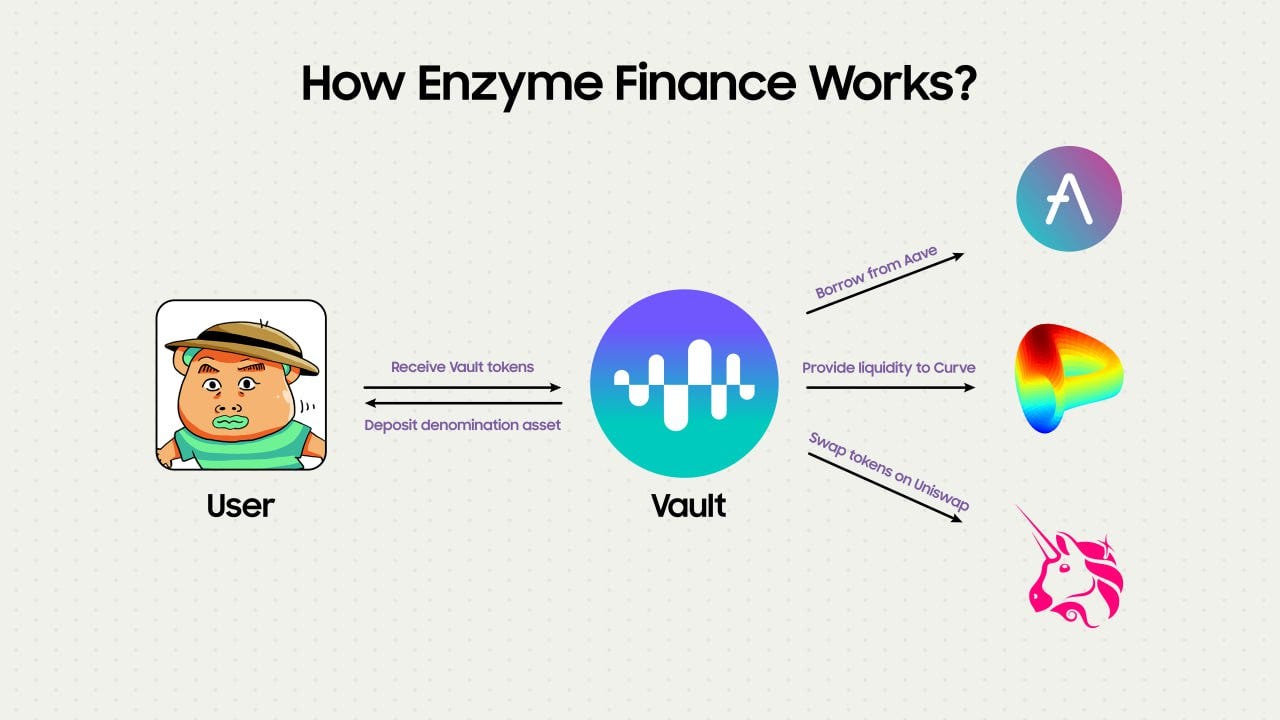

Enzyme Finance is built on the Ethereum blockchain, utilizing its decentralized infrastructure. The platform's structure is modular, consisting of a series of interconnected smart contracts. This design allows individual components to be updated or replaced without disrupting the entire system.

The core of Enzyme's infrastructure is called “Vault”, a smart contract responsible for holding assets and outlining their expenditure or investment parameters. The behavior of the Vault is influenced by various plug-in policies, which are also encapsulated within smart contracts. These policies set the rules for trading, asset management, and other related operations.

Enzyme's smart contracts have been subjected to multiple audits and tests. The platform employs a specific access control system, ensuring that only designated entities can interact with vital functions. For asset valuation, Enzyme relies on oracles, aiming for accurate pricing data. The platform also acknowledges potential risks, such as untracked assets and pricing deviations, and has mechanisms in place to address them.

Protection and Transparency

Transparency is emphasized in Enzyme Finance's operations. All actions, ranging from trades to asset management decisions, are recorded on-chain. This ensures that all data is accessible and auditable, offering users the ability to independently verify platform operations.

Enzyme has also established collaborations with external insurance entities like Nexus Mutual and InsurAce. These partnerships are intended to offer a layer of protection against potential vulnerabilities in the DeFi ecosystem. However, users are advised to familiarize themselves with the specifics of these insurance protocols.

Additionally, Enzyme's system includes a "Guardian" role. This role is designed to act in emergency situations. If a vulnerability or threat is identified, the Guardian has the authority to temporarily pause certain activities to address the concern.

User Experience and Accessibility

Enzyme Finance is designed with a focus on both novice and experienced users in the DeFi space. The platform's interface is intuitive, aiming to simplify the complexities of DAM. Users can easily create, manage, and invest in vaults, with each vault representing a unique investment strategy.

For fund managers, Enzyme offers a comprehensive toolkit. They can define their investment strategies, set fees, and choose assets, all while having the flexibility to change these parameters as market conditions evolve. The platform also provides detailed analytics, allowing managers to monitor their vault's performance, track assets, and make informed decisions.

Investors, on the other hand, benefit from a transparent investment environment. They can explore various vaults, view their strategies, past performance, and associated fees before committing their funds. Furthermore, Enzyme's documentation is thorough, offering guides, tutorials, and technical details.

IV. How about deFarm?

Liquidity and Financial Efficiency

deFarm's collaboration with Vertex Protocol, a decentralized exchange known for its robust liquidity pools and diverse asset offerings, serves as a foundational element in deFarm's liquidity strategy. Vertex Protocol's capabilities in offering a multitude of trading pairs provide a strong liquidity backbone for deFarm, facilitating seamless asset management and trade execution. However, it's important to note that deFarm's liquidity strategy is not confined to a single partnership. The platform is in the process of exploring additional collaborations with other decentralized exchanges and DeFi platforms to further diversify its liquidity sources and reduce counterparty risks.

On the financial efficiency front, deFarm is in the advanced stages of finalizing a fee structure that aims to balance the interests of multiple stakeholders. While the exact fee percentages are yet to be disclosed, the overarching goal is to establish a fee model that maximizes profitability for both asset managers and individual investors. This involves a careful analysis of transaction costs, slippage rates, and other operational expenses to ensure that the fees are not only competitive but also sustainable for the long-term viability of the platform. This multi-faceted approach to liquidity and financial efficiency is designed to offer a balanced and sustainable ecosystem for DAM.

Platform Infrastructure and Smart Contract Security

deFarm is architecturally structured with multiple layers, including a Social Layer for user engagement and an Infrastructure Layer for core functionalities. To be built on Ethereum and other L2 blockchains like Optimism and Arbitrum, deFarm aims for broad reach and utility. The platform’s smart contracts are subject to third-party audits and employ security mechanisms like time-locks and multi-signature approvals for sensitive operations.

The focus on multi-chain adaptability enhances the platform's scalability and reach, while the heavy load of smart contract design adds an extra layer of security. This multi-layered approach to security and transparency aims to make deFarm a reliable choice in the DAM landscape, setting it apart in terms of both infrastructure and smart contract security.

Protection and Transparency

deFarm is in the process of implementing a comprehensive security framework that will incorporate advanced cryptographic algorithms and multi-signature wallets. These elements are designed to provide multiple layers of security to safeguard against unauthorized access, data breaches, and potential vulnerabilities in smart contracts. Additionally, the platform plans to undergo regular third-party security audits to ensure the integrity of its code and the safety of its users' assets.

Transparency is another fundamental aspect that deFarm is keen to institutionalize within its operational framework. The platform is being designed to record every transaction on the blockchain, thereby providing an immutable and publicly verifiable record of all activities. This extends beyond merely documenting trades and asset allocations; it also includes transparent reporting of fee structures, performance metrics, and governance decisions when deFarm’s DAO is released. By ensuring that all these elements are traceable and auditable, deFarm aims to establish a high level of transparency that will not only foster trust but also facilitate compliance with emerging regulatory standards in the decentralized finance sector.

User Experience and Accessibility

deFarm is committed to developing a user interface that is not only feature-rich but also highly intuitive. The platform is being architected to support a modular design, allowing for the seamless integration of various decentralized finance tools and services. deFarm is also a permissionless platform, which means that anyone can create, manage, and invest in funds without any need for intermediaries or third-party approvals.

Accessibility is another critical dimension that deFarm is focusing on. Its dapp is being developed to be compatible across multiple devices and operating systems, ensuring that users can manage their assets on-the-go. Plans are also in place to introduce a series of educational resources, including tutorials, webinars, and FAQs, aimed at equipping users with the knowledge they need to navigate the complexities of decentralized finance.

What sets deFarm apart?

In the realm of DAM, several platforms have made their presence felt, but deFarm stands out for a multitude of reasons. Starting with TraderWagon, the platform's dependency on Binance's API and its off-chain operations raise questions about its commitment to true decentralization. While it does offer real-time copy trading, it lacks the robustness and security inherent in blockchain-based solutions. Moreover, its fee structure, intricately tied to Binance's VIP levels, can be a significant concern for long-term profitability of new investors.

Nestedfi, another competitor, presents its own set of challenges. Its complex fee structure, dependent on the Total Value Locked (TVL), could be confusing for new users. The platform's reliance on NestedNFTs to encapsulate portfolios introduces an additional layer of risk since NFTs are totally tradable. Furthermore, the limitation of up to twelve tokens in a single NFT could restrict users who wish to diversify their portfolios further. Nestedfi's technology is also unproven by any attacks in the past and could face unforeseen technical challenges.

Enzyme Finance, although a well-developed platform, has its own set of drawbacks. Its complex interactions and the attempt to combine multiple features into a single vault make it less user-friendly, particularly for retail investors who may find the platform overwhelming.

In contrast, deFarm distinguishes itself in several key areas. Its strategic partnerships, starting with Vertex Protocol, ensure robust liquidity, and its open architecture indicates that more DEX and DeFi partnerships are likely in the future. Unlike its competitors, deFarm is being designed with a strong focus on both technical robustness and user experience. Its architecture will allow for seamless integration of various DeFi tools, and its anticipated fee structure aims to balance the interests of both managers and investors.

Moreover, deFarm targets retail investors, simplifying the asset management process and offering more flexible product customization. From Single Farms for individual trades to Seasonal Farms led by a Manager for a specific period, deFarm is setting the stage for a more inclusive and adaptable DAM ecosystem.

V. Conclusion

In the evolving landscape of DAM, deFarm is gearing up to introduce a transformative approach. The platform's emphasis on transparency and security sets it apart, ensuring that users can navigate and manage assets with confidence. Additionally, the user experience has been a focal point for deFarm, aiming to provide both newcomers and experienced users with intuitive tools and interfaces.

While deFarm is still in its pre-launch phase, the strategic direction and features it promises are indicative of its potential to make significant strides in the decentralized finance sector. The platform's design and objectives suggest that it is not only prepared to meet the current demands of the market but is also forward-thinking, positioning itself for sustained growth and influence in the industry.