Social Trading - from TradFi to DeFi

Introduction

During the market downturn of 2020 caused by the COVID-19 pandemic, investors worldwide lost trillions of dollars in stock and bond markets. Crypto traders alone suffered more than $1 Billion in liquidations when Bitcoin dropped from 30k to 25k this August.

The market has only three primary states: bullish (upward trending), bearish (downward trending), and sideways (consolidation). Two out of three won’t make you lose money. However public data show that more than 80% of traders are losing money in every trading market. Why?

Because trading and investing are multifaceted pursuits, demanding a blend of knowledge, experience, keen trend analysis, chart-reading prowess, and the ability to decipher complex reports. These endeavors require unwavering attention, perfect timing, and a dash of luck to stay attuned to ever-evolving market news.

Without these essential capabilities, the trading journey can be treacherous, leading to financial loss, frustration, and even deterrence from future investments. Some may stubbornly return to the scene, only to compound their losses.

Now, imagine a friend who's really good at this stuff, helping you out. That's what Social Trading is all about. It's like getting guidance from experienced traders who share their knowledge and strategies with you. It makes learning easier and encourages new traders to stick around until they get the hang of it. Plus, it's a way to connect with others on the same journey because trading can be a bit lonely sometimes. It's not only beneficial for traders but also for the people who manage investments.

In a nutshell, Social Trading is like having a knowledgeable friend guide you in the world of trading and investing. However, like any adventure, there are risks. Technical glitches, market downturns, and most notably, human errors, all pose potential pitfalls.

The story of Social Trading is deeply intertwined with the broader evolution of finance. It's a tale that spans from its humble beginnings as trading advice and tips to its resurgence in the digital age, riding the wave of social media's dominance. Furthermore, it's a concept that continues to evolve, now intertwining with the realm of decentralized finance, known as DeFi.

From word-by-mouth trading tips to FX copy trading platforms to today’s smart-contract-based protocols, the journey of Social Trading is fascinating. In this article, we'll embark on a journey through its history, exploring how it has reshaped the financial landscape and how it differs between traditional finance and the emerging world of DeFi.

A Brief History of Social Trading

Trading is by its very nature a social phenomenon. Since the inception of markets, discussions and conversations about them have thrived. The roots of Social Trading run deeper into history than you might imagine. From the dawn of trading, people have longed for advice, tips, and tricks from others.

In the 1923 classic, "Reminiscences of a Stock Operator" by Edwin Lefèvre, the psychology of trading tips was described like so:

"Tips! How people want tips! They crave not only to get them but to give them. There is greed involved, and vanity. It is very amusing, at times, to watch really intelligent people fish for them. And the tip-giver need not hesitate about the quality, for the tip-seeker is not really after good tips, but after any tip. If it makes good, fine! If it doesn’t, better luck with the next."

This tradition of sharing trading insights has continued to evolve over time, adapting to changing social preferences. Certain traders and investors with proven track records began publishing newsletters to showcase their investments, their positions, and the rationale behind their choices. The advent of technology and the explosion of social media elevated this practice, expanding it beyond printed words to encompass email, internet forums, information-sharing platforms, and today's real-time social media.

The true transformation of Social Trading appears to be unfolding in the era of Millennials and Gen Z, where Social Media takes center stage. Considerable effort has gone into understanding the needs, preferences, and requirements of these younger consumer generations.

Millennials were born in a rapidly changing world where Web2 shifted to Web3. Gen Z, on the other hand, are true digital natives, with most unable to remember a time before smartphones and computers.

For Millennials, investing is a departure from their parents' methods. They are keen on harnessing technology to democratize finance, seeking transparency, ease of access, and community engagement in their investment endeavors. The rise of the meme stock phenomenon and the GameStop saga in 2021 showcased Millennials' power to mobilize on platforms like Reddit, upending traditional market dynamics. These events illuminated the potential for decentralized online communities to influence financial markets in ways that were previously unimaginable.

Gen Z is distinctive in that they tend to obtain information almost exclusively from online sources, with social media serving as their primary news outlet. Their investment behaviors reflect this digital upbringing. They are more inclined to explore digital assets, cryptocurrencies, and fintech innovations, often challenging traditional financial models.

The 2021 cryptocurrency hype, with phenomena like Dogecoin and the rise of meme coins, demonstrated Gen Z's affinity for digital assets and their ability to quickly mobilize and influence the financial landscape through social media platforms. They have an inherent understanding of the power of online communities and use it to their advantage.

What's intriguing is that while technology may have altered the medium through which tips are shared, the core principles have remained constant. People now gather around Telegram groups, Discord channels, or Friend Tech chat rooms, eagerly seeking information, news, trade setups, and tips. These social activities also empower individuals, often referred to as "normies," to share their thoughts, achievements, and more. This is the true essence of Social Trading, extending far beyond the capabilities of mere Copy Trading.

Today, the practice of tips-sharing and social investing continues to evolve, with the help of technology. Social Trading in the age of Web3 is more accessible, more transparent, and more decentralized.

Traditional Social Trading Vs. Decentralized Social Trading

Social Trading is a form of investing that allows investors to observe the behavior of experienced traders and follow their investment using a form of copy strategy or mirror trading. It is an alternative way to analyze data, watching what others are doing, and copying their techniques and strategies, thus not needing to deepen knowledge in technical or fundamental analysis.

Basically, it is a social network of trading, in which instead of posting photos, selfies, and statuses, participants interact, observe trading results from other professionals, and discuss real-time market situations.

In traditional finance, traders can employ various social trading strategies depending on their objectives and risk tolerance. Some of the most common strategies are:

Social Following: This strategy entails following the trades and insights of other traders then they can use the shared information to make their informed decisions.

Copy Trading: This strategy involves replicating the trades of other traders. Traders can choose which traders to follow based on their performance, risk profile, and trading pattern.

Crowd Trading: Rather than following the trades and insights of a single trader, this strategy involves following the trades and insights of a group of traders. It can provide a more diverse view of the markets while potentially reducing risk.

Portfolio Mirroring: This strategy involves replicating a trader’s entire portfolio rather than individual trades.

Hybrid: This strategy combines social trading strategies, including copy trading, following, and portfolio mirroring. It can result in a more varied and well-rounded approach to trading.

MIT scientist and researcher Yaniv Altshuler described Social Trading networks as complex adaptive systems: “Having the inherent ability to share ideas and information with each other, users OpenBook users get a new source of information, which they can use to improve their trading performance. Because users are not fighting against each other, but against the market, this situation becomes a zero-sum game, encouraging users to share as much information as possible.”

Traditional Social Trading platforms have their advantages and disadvantages.

Decentralized Social Trading platforms were born to praise the advantages of Traditional Social Trading and address its problems. Compared to its CeFi, DeFi allows:

Accessibility: DeFi is built on open-source blockchain technology, making it accessible to anyone with an internet connection, whereas traditional finance is typically only accessible to those who have established relationships with financial institutions.

Trustlessness: In traditional finance, trust is placed in a central authority or intermediary to ensure that transactions are executed correctly. In DeFi, trust is placed in the code and protocols of the blockchain, allowing for trustless transactions.

Transparency: DeFi transactions are recorded on a public blockchain, allowing for transparency and audibility of all transactions.

Immutability: Once a transaction is recorded on a blockchain, it cannot be altered, which ensures that the transaction is irreversible and that the records are tamper-proof.

Censorship-resistance: Decentralized systems are more resistant to censorship as there is no central point of control, meaning that no single entity can prevent transactions from occurring.

Interoperability: DeFi platforms can interact with each other through smart contracts, allowing for the creation of new financial products and services.

Decentralized ownership: DeFi protocols allow for decentralized ownership, meaning that anyone can participate in the network regardless of location or financial status.

DeFi enables a Social Trading environment where your on-chain data reflects your tweet, your commission comes from your success, and your losses align with your followers' losses. A Social Trading platform that is transparent, accountable, and competitive.

It’s transparent in that everyone should see — in an instantly verifiable way — a trader’s trading record in as close to real-time as possible.

It’s accountable in that it makes sure that the manager has own funds at stake, ideally proportionally to the amount of investor funds the trader is allowed to take on.

It’s competitive in that managers compete for investor funds with their track record, trading strategy, etc. Let them present a wide selection of offerings to the investor and let the investor be able to compare various traders side-by-side easily.

While DeFi Social Trading theoretically offers more advantages than its traditional counterparts, it is still in its infancy and lacks the well-established infrastructure, widespread acceptance, legal frameworks, and professional advice that traditional finance provides.

According to recent research from The Insight Partners, the Social Trading platform market size was valued at $2.22 Billion in 2021. It is expected to grow to $3.77 Billion by 2028, at a CAGR of 7.8%.

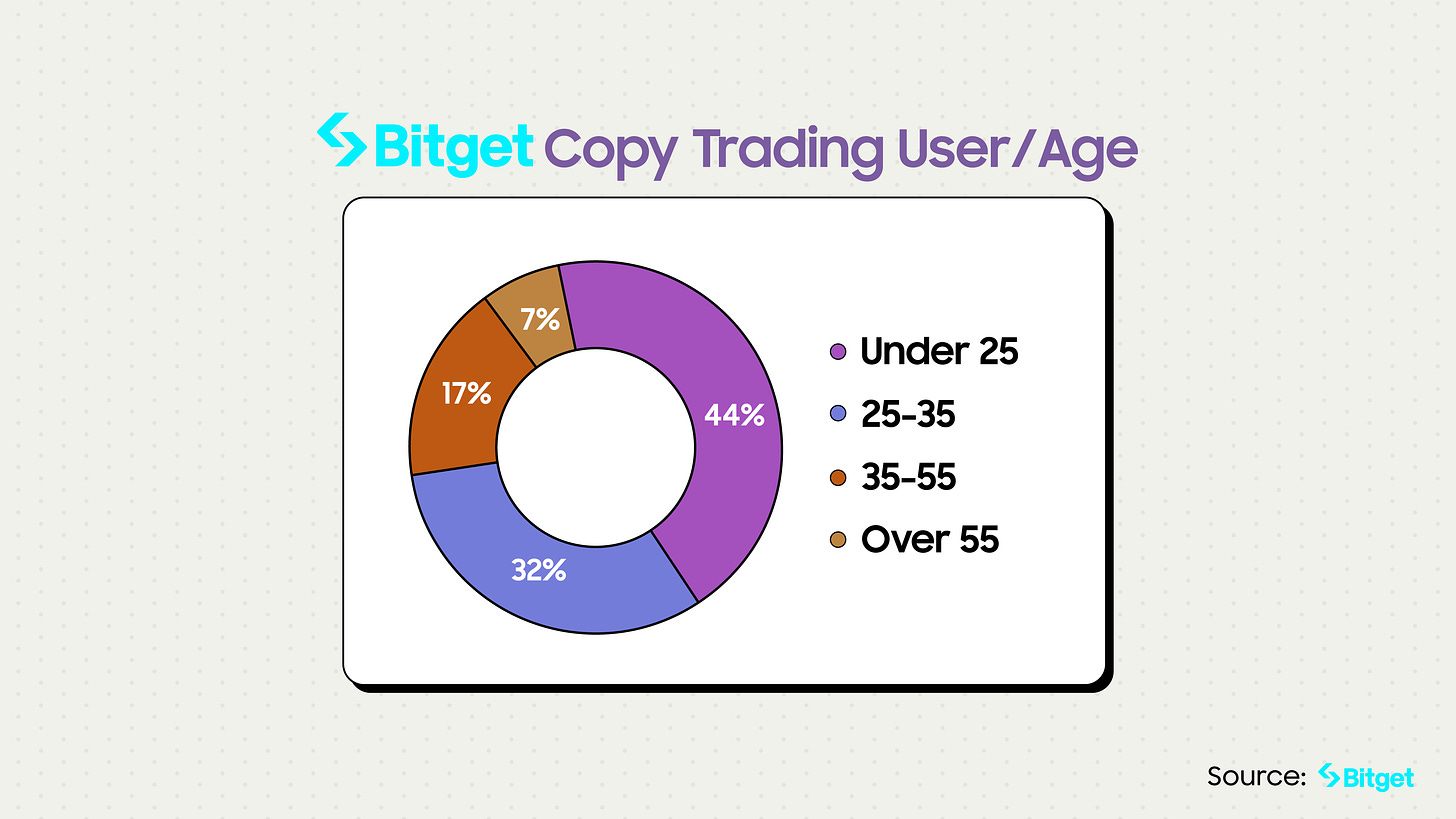

Social trading has long been popular among Forex traders and now it's making its way to crypto. And Gen Z is leading the way. The data from the Bitget exchange reveals that Gen Z users account for 44% of all copy trading users, exhibiting the highest interest in this trading strategy whilst older crypto traders also leverage copy trading to gain market trends and insights.

In the end, the younger generations, including Millennials, Gen Z, and even Gen Alpha, are likely to gravitate toward platforms that offer smooth onboarding, gentle learning curves, and, most importantly, a sense of community. These platforms allow them to learn from their peers and follow the crowd until they become more proficient.

This is the vision we aim to realize with deFarm - a Social Trading platform that combines the best of both traditional and decentralized finance to empower the next generation of investors.

Welcome to deFarm: Where Social Trading Meets Decentralization

deFarm is not just another DeFi platform; it's a bridge between the world of social trading and decentralized finance (DeFi). As a chain-agnostic (multichain) Web3 Social Investing Platform, deFarm has a singular goal: to harness the strength of communities, making on-chain investing accessible and efficient for everyone.

In line with the "DeFi Vault" concept and the "Vaultification" trend within the DeFi space, deFarm offers a user-friendly platform that marries the best of social trading and DeFi. While delivering a futuristic and effortless user experience, we're rewriting the rules of engagement in the world of finance.

With deFarm, you're not just an investor; you're a part of a thriving social investing community. Whether you aspire to be a fund manager, an investor, or dive into the world of NFTs, our platform empowers you. Join us in unlocking the full potential of decentralized investing while embracing the principles of decentralization and socialization.

Every action on our platform happens on-chain, following a non-custodial methodology. Your assets remain under your control, fortified by the security of blockchain technology. We're committed to providing a user experience that's more than just user-friendly; it's user-centric, driven by a dedication to inclusivity and transparency.

deFarm is committed to pushing the boundaries of DeFi innovation. We are constantly seeking out new and unique ways to provide value to our users. Our latest implementation includes Game Theory, Gamification, and the essence of SocialFi.

At deFarm, our mission extends beyond finance. We're on a journey to foster the Creator Economy, where everyone has a stake in the future. We believe in the power of communities, the innovation of DeFi, and the limitless possibilities of Web3. Welcome to deFarm, where we invest together for the better.

Website: https://de.farm/

DeBank: https://debank.com/official-account/112604/

Twitter: https://twitter.com/defarm_ETH