Why deFarm?

Derivatives trading on-chain has really taken off, with big players like GMX seeing $166 billion in total volume, and Vertex Protocol not far behind at $72 billion. These numbers are still climbing, especially now that the market is on an upswing.

Given this momentum, it’s no surprise that the idea of copy trading or managing assets on-chain is getting a lot of attention. However, not every platform aiming to innovate in this space has hit its mark or made a significant impact. Let’s look at some examples to see why they might not have reached their goals.

Then, this is where deFarm jumps in. We've taken a close look at where others might have missed the mark and used those insights to make sure we do things better. Alongside learning from the misses, we're also taking the good stuff and doing it even better, in ways that really fit with what the market and users need today. At deFarm, it's all about building on solid ground, taking the best of what exists, and bringing it to serve our community. This way, we define ourselves not as an option out there, but as the place where traders and investors find what they've been looking for.

I. Unsuccessful cases

Just like startups in Web2, Web3 projects face similar, if not greater, risks and uncertainties. The expectations of Web3 users are often much higher than those of Web2 users, adding much to the challenges. There's no guaranteed recipe for success in this innovative yet volatile space. Several critical factors play into the success or failure of a project - market conditions, the product itself, marketing strategies, foundational theories, or sometimes, even a misstep as minor as an intern's social media post can tip the scales. Now, let's look into a few examples of projects that, from our perspective, didn't hit their targets.

Solana Asset Management platforms

There were several Asset Management Platforms/Copytrade options on Solana, with Solrise being the biggest name among them. They launched their product in 2021 but had to shut down in 2022 after things on Solana took a downturn.

To get a sense of what happened, it’s helpful to check their social media: SolriseFinance Twitter.

Like deFarm, Solrise didn’t hold onto liquidity themselves but instead outsourced it to DEXs on Solana: Jupiter and Mango Market. They focused on bringing KOLs/Traders onto their platform.

However, their Achilles' heel was the limited number of trading pairs available on Mango Market and Jupiter, which remains minimal to this day. They couldn't compete with even the smaller CEXs, let alone giants like Binance, Bybit, or OKX. It's unrealistic to expect traders to flock to a platform that only offers BTC, ETH, and SOL for trading.

Another critical issue was Solana's instability at the time. Conducting Perpetual Trading on a blockchain that experienced downtime 10 times a year was too risky. The collapse of FTX only added to their troubles.

Despite these challenges, Solrise did identify important focal points: Traders and Community. Props to them for that.

dHedge

dHedge stands out significantly in the Web3 Asset Management space, potentially being one of the biggest names here.

Having raised over $12 million from some reputable names, they remain active to this day.

The key difference between dHedge and deFarm lies in their focus areas. dHedge prioritizes Autonomous Strategies and various DeFi activities, targeting Western hedge funds interested in developing automatic strategies. On the other hand, deFarm currently concentrates on Active Asset Management with DEXs Trading, catering more to individuals interested in engaging and leveraging on volatile assets with others.

While it might not be entirely fair to compare dHedge with deFarm, it's worth mentioning that from the perspective of the VCs who invested in them, dHedge hasn't lived up to expectations. Despite raising $12 million, their TVL is around $40 million - a figure that dipped to $10-20 million during the bear market - and their trading volume hasn’t been particularly impressive. This has led to perceptions of the asset management market being bearish.

However, it's important to remember the story of Axie Infinity, which didn’t take off immediately in 2019 and even into 2020.

One of the reasons dHedge hasn't captured widespread interest is that it wasn't designed for the average investor. It’s created for institutions looking to dip into crypto markets with reliable yields and income, rather than for the general public. For everyday investors, a 5-7% yield through Stablecoin Liquidity Pools isn't attractive, especially when they have the option to manage their investments themselves.

Yet, as institutional interest in the crypto market grows, these entities might opt to either develop similar platforms on their own or turn to dHedge. Protocols similar to EthenaFi/Delta Neutral Strategies could be implemented on dHedge. The interest simply hasn't been strong enough yet, but that doesn't mean it won't be in the future.

However, it must be acknowledged that dHedge’s tokenomics were not particularly well thought out, and launching during a DeFi bear market certainly didn't help their cause.

Nested.Fi and Valio.XYZ

Nested.Fi and Valio.XYZ are grouped together here due to their noticeable similarities. Both platforms are designed as copy trading tools, created by individuals who are not traders themselves and struggling to pinpoint a unique selling proposition (USP). Nested.Fi has gone through a rebranding to Mass.Money, while Valio.XYZ has not been generating significant trading volumes.

The design of these platforms does not seem to attract serious traders or investors, perhaps with the exception of a Gen Z audience.

It’s essential to understand the difference between Copy Trading and Asset Management, as they might seem similar but are quite distinct. Web3 Copy Trading involves finding an individual or institution whose performance or investment thesis you admire and attempting to replicate their strategy. On the other hand, Asset Management involves entrusting your funds to a third party. Profits are shared, but management fees are involved. Comparing Web3 Copy Trading with Asset Management could be the same as the difference between pirating music/movies and paying for them. Copying someone without their permission offers no incentive to the original strategist. Without incentives, such practices can be easily exploited, especially by whales and high-net-worth individuals who are increasingly aware of on-chain tracking. They might think, “Why should we let these freeloaders benefit from our strategies?” and take actions that could render the most closely watched wallets ineffective or use them as tools for market manipulation.

Meanwhile, Asset Management provides Asset Managers the incentives and rewards to manage assets for other users. New Creator Economy. But in the case of Valio, what kind of incentives are they actually receiving? Are we talking about 1-2% of Assets Under Management (AUM)? Or perhaps 10% of the profits made on those AUMs?

Consider a scenario where Manager A's AUM is $1 million, and they achieve a 20% Return On Investment (ROI), a standard figure in the industry. This means, after a year, they would earn between $20,000 to $40,000 USD. This calculation stands only if they indeed manage an AUM of $1 million, which is a figure even the platforms themselves struggle to reach in total.

Why don't these platforms have significant AUMs? The simple answer is the lack of users. They struggle with marketing to the right audience—those who are willing to entrust their funds for passive income. Moreover, they find it challenging to attract skilled traders or KOLs to the platform since the only incentives available are marketing fees. In Web3, the mantra often is: no token, no fun. Tokens are vital for aligning the incentives of individuals and the community that contribute to building everything. Yet, these platforms have secured investments from VCs, who are unlikely to favor diluting their investments by distributing tokens freely to every user online.

And another point to consider: one year is a long time in crypto, at least as things stand currently. Few traders are interested in committing to a platform for a full year just for a $20,000 paycheck—except maybe those hunting for airdrops.

However, there are other notable names in this space worth mentioning and learning from, including STFX, Hyperliquid, and Ox.Fun. It's likely there are more projects in the pipeline that aren't on the radar yet, along with others that are set to launch. This signals a highly competitive environment in the near future for this sector.

II. The Rising Stars

STFX

It’s important to acknowledge STFX, as their thesis on "The Vaultification of Everything" has been particularly inspiring. They argue for a unique approach to structuring crypto investments, which you can look into through their detailed exploration on Medium and The Mothership's insightful analysis.

STFX states that given the typically short attention span of crypto traders, each DeFi Vault should focus on a single position. While there's strong disagreement with this perspective, it’s undeniable that STFX stands out for its execution among the platforms discussed, achieving better volume accumulation. Yet, there’s a strong belief that deFarm could match or surpass STFX’s accumulated volume in just one month, as opposed to a year.

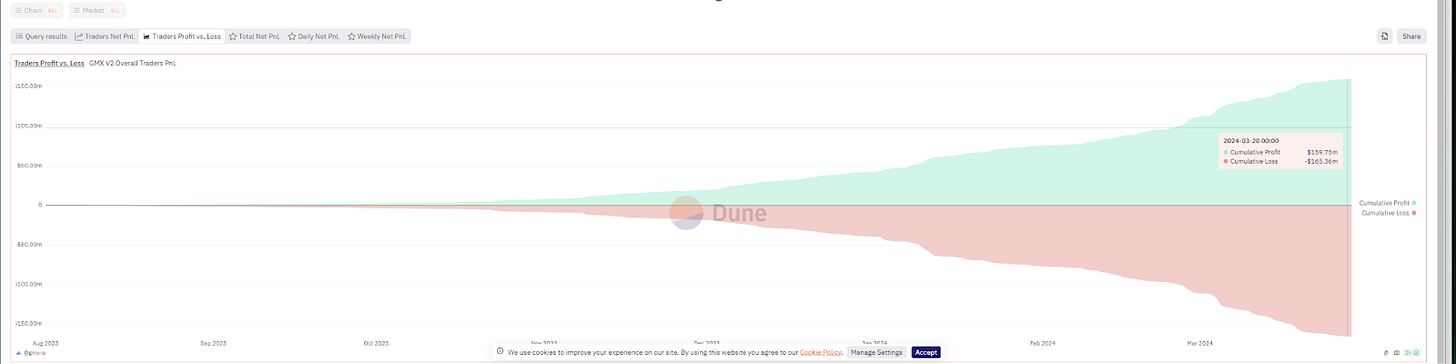

This shows two crucial points. First, the importance of social trading and co-investing. Second, take a look at their statistics:

Now, compare to the situation with GMX Traders on Dune:

It revealed one key concept: Specialization. The specialization of the labor force is fundamental. Just as you wouldn't seek a professional athlete's assistance during a medical emergency but rather a doctor's, it's unreasonable to expect everyday people to trade as proficiently as professional traders.

The concept of co-investing or social trading has been recognized for its potential to generate profits for retail investors over the long term, and many are well aware of this. That's precisely why the demand for such services on CEXs is continuously growing. Look at platforms like OKX, Binance, or Bybit. Even eToro is generating more profit than most of the top 100 companies listed on CoinMarketCap. This begs the question: Why not implement social trading on the blockchain? Further thoughts on this topic have been shared by our CEO here: Tweet by @cuongdo_cl.

Despite the innovative approach of STFX, it's noteworthy that their volume, along with profit and revenue, remains low. This level of performance is particularly concerning for exchanges. With this in perspective, it's worth turning attention to Hyper Liquid to understand their strategy and operations.

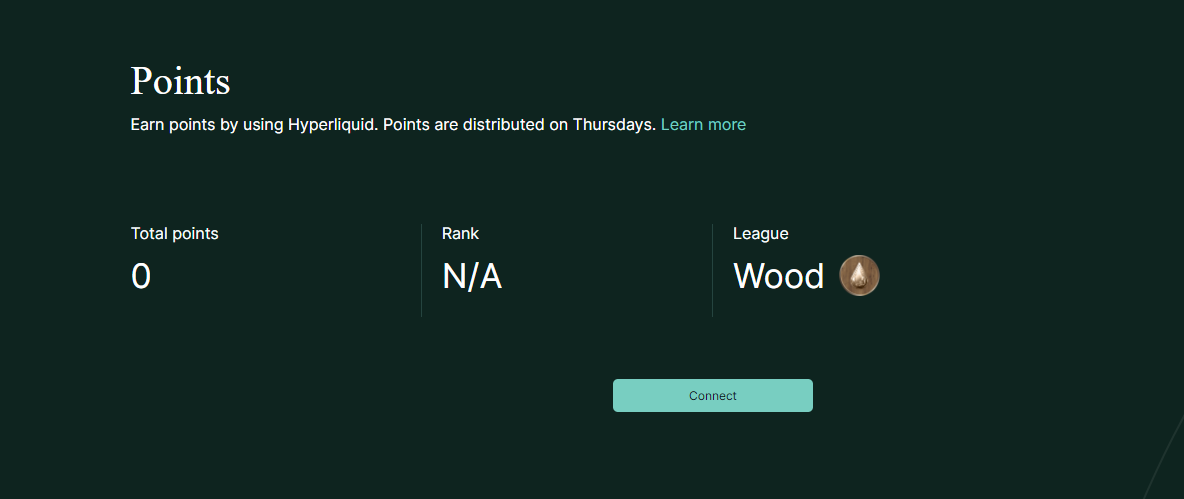

Hyperliquid

The standout core of Hyper Liquid compared to other platforms discussed is their ownership model: they own the blockchain, the infrastructure, the liquidity, and they've implemented social trading through User Vaults. This comprehensive control contributes to their superior volume, TVL, and other metrics. The driving force behind this success? Incentives.

It cannot be emphasized enough: In Web3, incentives are key. What accelerates the pace of Web3 startups beyond that of Web2 companies is the distribution of incentives for contributors. Programs rewarding points have proven to be a significant motivator, overshadowing other factors like user UI, speed, and additional features, which are merely bonuses. It's the incentive programs that attract and retain traders.

Hyper Liquid recognizes this, adopting strategies similar to those of the top CEXs, and their success speaks for itself. However, this success brings to light a crucial question regarding their future: what happens to HyperLiquid's user base once the incentive programs, like point systems and airdrops, stop? Will traders remain loyal, or will they migrate to other platforms in search of new incentives?

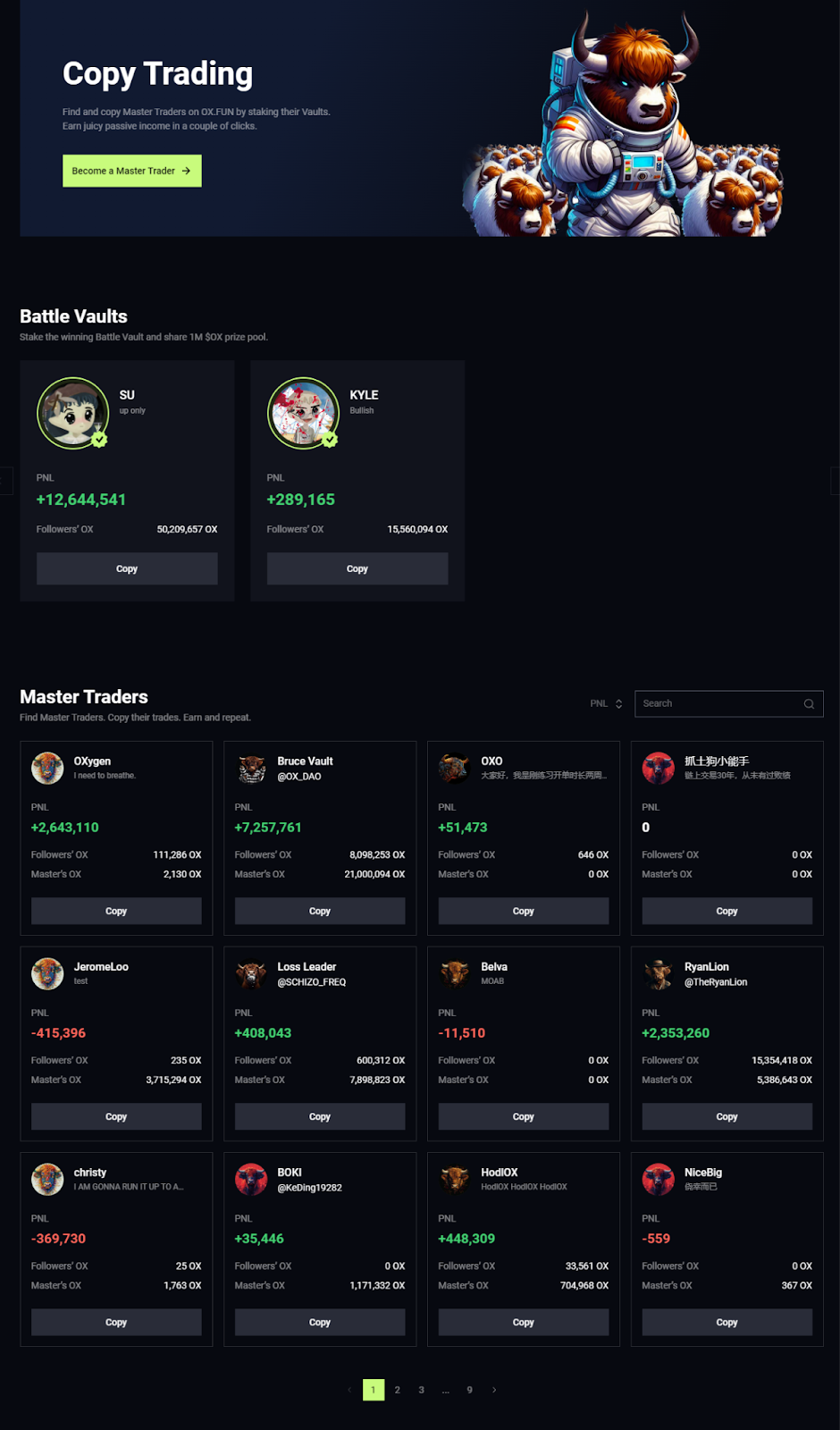

Ox.Fun

Ox.Fun stands out, particularly for its marketing strategy, which is perhaps not surprising given the backing of notable figures like Suzhu and Kyle (3AC Capital founders). It's essentially the on-chain iteration of the Oxbull Exchange, which was shut down a few months ago. However, making a bold comeback, they've decided to distribute their tokens directly to Master Traders.

The revenue model is straightforward yet clever: earnings come from the trading fees and the circulation of OX tokens. This setup creates a self-sustaining cycle where users purchase OX tokens, stake them to earn profits, and, in turn, contribute to the platform's revenue through fees and token purchases. The profits are then distributed to Master Traders, who attract more followers to the platform, enhancing its growth and activity.

This strategy, simple in its essence, proves to be highly effective, showing the power of community and incentivization in crypto. Oxs are powerful in herds. Yet, surprisingly, not many others have adopted this model. This is where deFarm enters the picture, ready to introduce our offerings to the market of on-chain trading and asset management. "We All Gonna Make It" (WAGMI) becomes not just a hope but a plan of action for deFarm.

III. WHY deFarm?

This article has been a journey, and if you've dedicated your 15 minutes to reading up to this point, heartfelt thanks are in order. It truly means a lot, especially in a world full of less-than-ideal VCs and investors chasing quick profits. Few understand the vision that trading not only should but will shift entirely on-chain. This transition represents an opportunity within an industry primed for substantial revenue generation - a rare chance in our lifetime to be part of a significant wealth transfer.

Envision this: by 2030, the volume of on-chain/DEX trading could match the volume of CEXs in 2024, potentially reaching $100 billion per day. If deFarm captures just 1% of that volume, that’s $365 billion a year. Translating this into revenue at 2 basis points (BPS) results in $73 million annually from fees alone, not to mention additional income from other activities. A business generating $100 million in revenue per year doesn’t sound too bad, does it?

But the critical question remains: How can deFarm achieve this? What sets deFarm apart from its competitors? And what are the chances of deFarm capturing 1% of the on-chain trading volume?

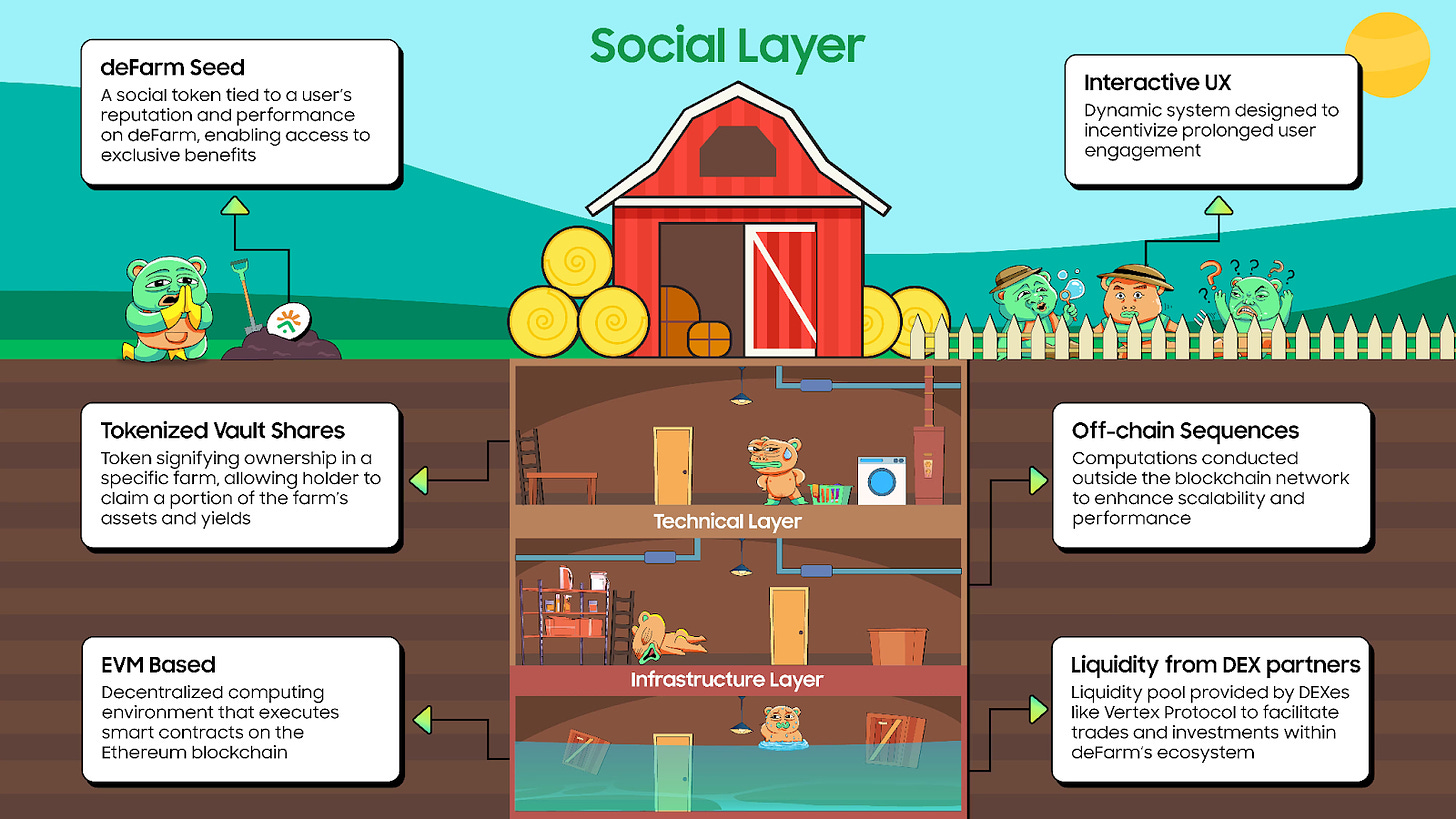

deFarm's primary advantage over others lies in its unique position not just as an asset management platform or a DEX, but as a SocialFi platform. Our strategy focuses on the social aspects of trading, incentivizing top traders to join deFarm and encouraging them to manage assets effectively for other users. By prioritizing the social engagement of our platform and the quality of participants, we believe the volume, retail investor engagement, and, consequently, revenue will naturally follow.

So, welcome to deFarm—where trading meets community.

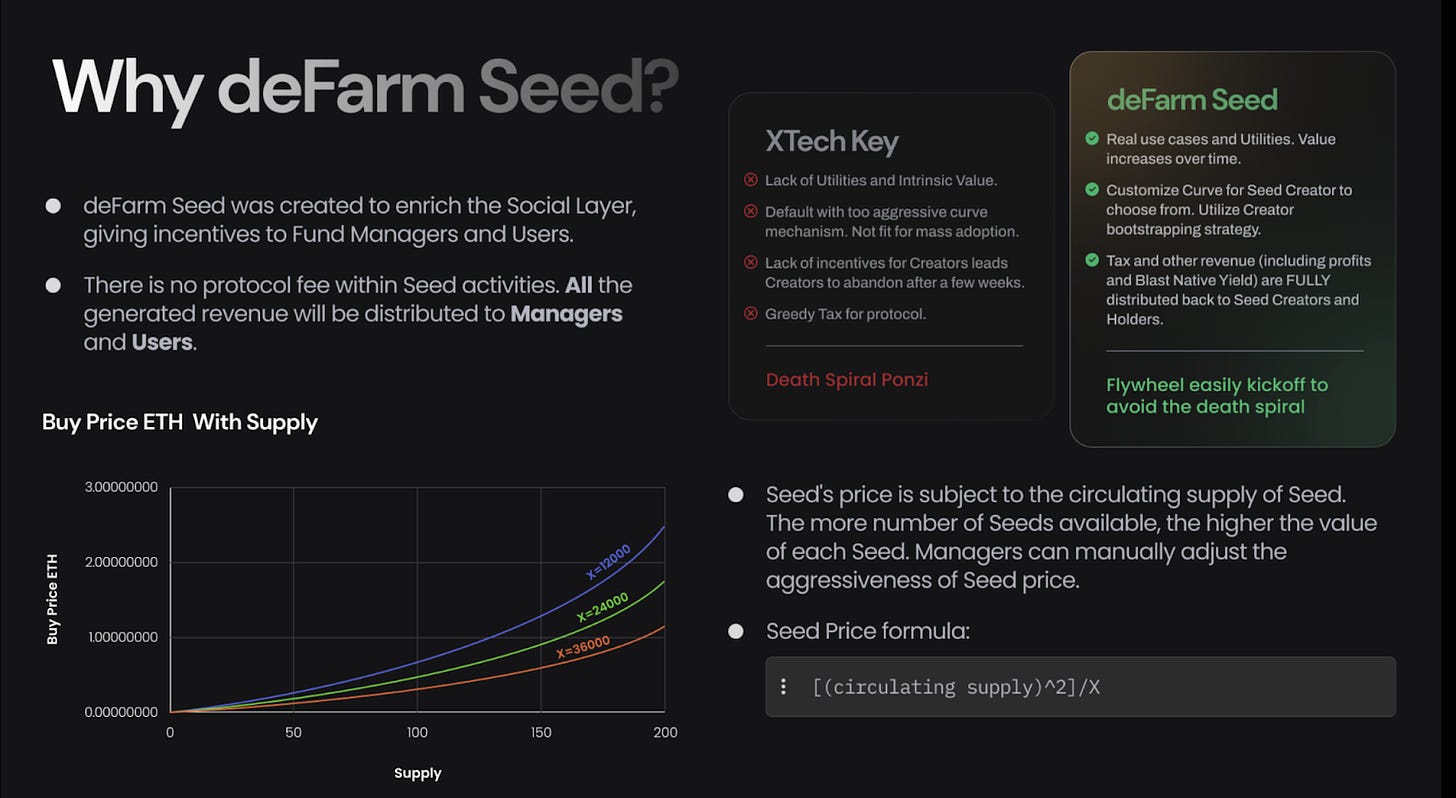

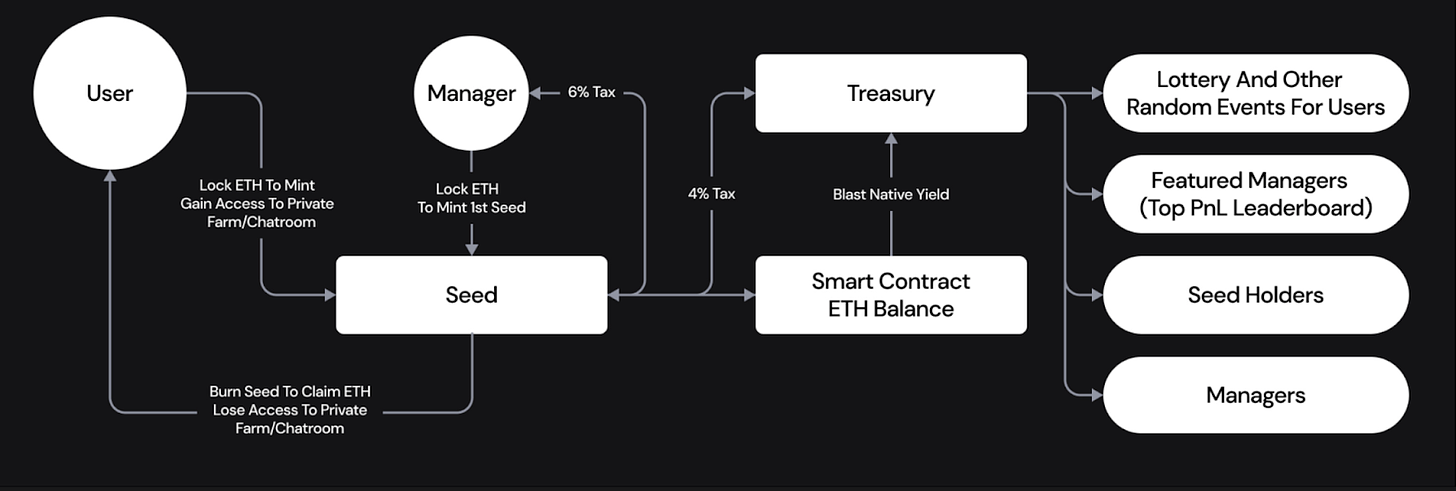

First, enter the Seed Mechanism

If you ever witness the Friendtech rise during 2023 or the Bitclout rise during 2021, you will understand. The Seed Mechanism, similar to the strategies employed by these platforms, allows users on the platform to mint their own tokens and sell them to their followers. The mechanism is clear: the earlier you participate, the better the deal. People argue it is a Ponzi scheme, with KOLs potentially exploiting their followers for profit. While there's validity in these concerns, it's also important to acknowledge a broader perspective - that most structures within human economics share characteristics with Ponzi schemes. From real estate and infrastructure to even religion, the sustainability of many systems relies on continuous buy-in from a growing base of participants.

The distinction between what might be considered a 'good' Ponzi (like real estate, where the underlying value and utility can increase over time) and 'bad' ones (such as MLM schemes, which often offer little to no real value) lies in the utility and benefits they deliver.

That's where deFarm’s Seed Mechanism does better. Unlike fren.tech, which only offers access to a chat group as its perk - something you can't even be sure is worth your money - deFarm's Seed provides clear benefits. These benefits are all about helping those who hold Seed tokens to make a good profit. So, with deFarm, you know you're getting something valuable.

Furthermore, deFarm introduces Seed Curve, which means the creator can set the aggressiveness of the Seed Price, allowing multiple benefits to their strategies.

The Wheel: our way of giving back to the community, setting us apart from others like FT by redistributing everything back to the community. Add to this the native yield from Blast, which offers about 5% APR plus points from Blast, and you've got a huge incentive for traders.

Let's break down the numbers for clarity. Suppose Blast's TVL is now $1 billion, and our platform captures $20 million of that TVL, which is just 2%. At Friendtech's peak, their TVL was $40 million. With a tax of 4%, we're looking at $800,000 USD. Adding the native yield gives us another $100,000 plus points in just the first month. This means there's $1.2 million available to reward our top traders. The numbers speak for themselves.

Another exciting feature we offer is the Quest system. It's a set of challenges and a points programs that rewards users for participating in deFarm during the Mainnet Beta. You can check it out here: https://staging.de.farm/quests/. If you have trouble accessing it, just use a referral code.

And here's a bonus: users earn 10% points from their referrals. But keep in mind, that referral codes will be limited at the start, so it pays to be quick.

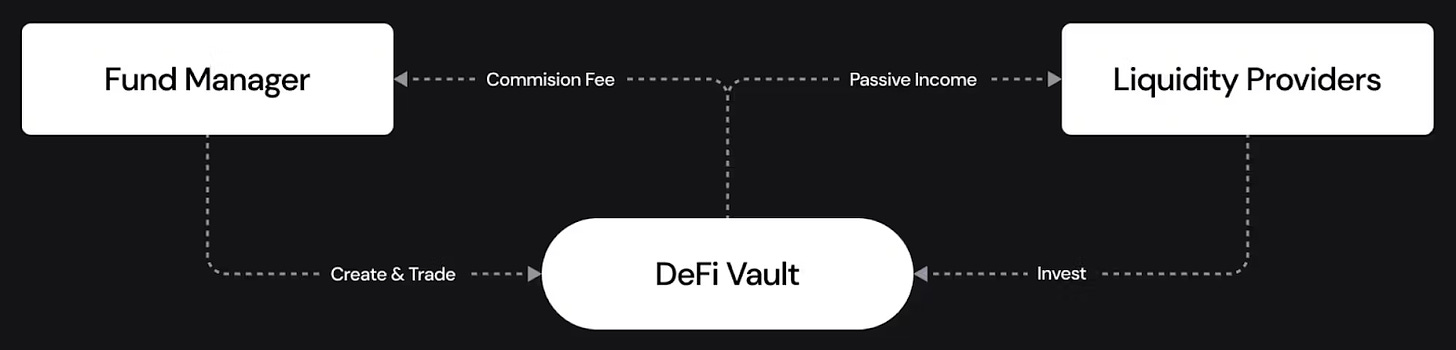

Then, we see the Asset Management Layer

It's designed for those who love to dive deep into asset management on-chain, and let's call them Onchain Degens. These folks get a thrill from setting up quick vaults, always chasing that next big win.

At deFarm, our community is made up of two main groups: Fund Managers and Liquidity Providers, each playing a vital role in our ecosystem.

Fund Managers are the trading pros. They've got the skills, market knowledge, and are deeply invested in their trading activities, often treating it as their primary profession. Because of their expertise, their investment strategies typically yield higher returns compared to the average investor. On deFarm, these Fund Managers can set up DeFi Vaults to pool resources from other users. With the funds collected, they actively engage in trading, aiming for profits. Successful trades mean commission fees for them, and since all their trades are recorded on-chain, they also get to build a solid trading reputation.

Liquidity Providers, on the other hand, are individuals with spare funds but perhaps not the time, interest, or trading skills to maximize those funds through trading. They might view trading as a secondary activity or something that's too risky to dive into without the proper knowledge. This group stands to benefit from investing their idle funds with Fund Managers on deFarm, avoiding the potential losses they might incur if they ventured into trading on their own.

Initially, we're zeroing in on Perpetual and Spot Trading. This is where we start, but it's just the beginning.

Next up, we plan to expand into NFTs, real-world assets, and various restaking opportunities. The future could bring us into realms like Prediction Markets, Lotteries, or even Gambling. The sky's the limit here.

IV. Conclusion

deFarm is built on real lessons from crypto, made by people who live and breathe trading. Our team is a mix of traders, degens, and DeFi addicts who know the ups and downs of the market. We've put our own experiences into making deFarm, creating a place that's safe and smart to trade and invest.

Looking forward, deFarm remains committed to pushing the boundaries of not only on-chain Asset Management but SocialFi as a whole. We're not just developers; we're users, we're traders, and we're believers in the potential of on-chain derivatives market for wealth generation. Join us in shaping this future, one trade, one innovation, and one success story at a time.

To reach our ambitious goals, deFarm has set clear criteria for our tokenomics, focusing on utility, demand, and sustainability. We aim to reward the good actors in our community, even social contributors and hype men, while designing a system that naturally discourages bad actors. Sustainability is at the core of our approach so that deFarm and its ecosystem can thrive long-term. Above all, we prioritize our community, shaping tokenomics to benefit loyal supporters and attract new users, making our platform a welcoming space for everyone interested in the future of on-chain degen. For more information, check out our thesis here.

WAGMI.